Did you just find an bank transaction with a charge labelled “TST” in your monthly credit card or bank statement? You must be wondering what it means, hoping it’s not part of a scam and just another purchase you made using your bank account.

Don’t fret, the TST bank charge isn’t fraudulent. So what is TST on your bank or credit card statement and why does it appear?

What Is the TST* Bank Charge?

The TST charge on a credit card statement refers to a processing fee charged by Toast, Inc., a popular payment processor that offers point of sale (POS) services for various merchants.

What Does TST Stand for?

The fee is applied to each transaction made on merchant accounts that use Toast’s payment processing platform. Toast offers POS systems for businesses such as restaurants, cafes, and bars, making it a popular choice for many merchants.

The TST charge is typically a percentage of the sale or a set fee that is charged to the merchant based on the amount of the transaction.

This fee can vary from transaction to transaction, depending on several factors, such as the type of transaction, the amount of the purchase, and where the transaction took place.

Image Credits: ToastTab

While seeing the TST charge on your credit card statement can be confusing and leave you questioning its legitimacy, it is important to understand that this charge is genuine and there for a reason.

You can usually find more information about the charge by checking the merchant code or description on the statement. From this information, you’ll know which merchant made the charge and what transaction led to the TST charge.

Came across an unknown charge named MBI on your credit card statement? Here’s how to make it go away.

How to Find the TST Charge on Your Bank Statement?

To find the TST* charge on your bank statement, you can:

Step 1: Check Your Transaction History

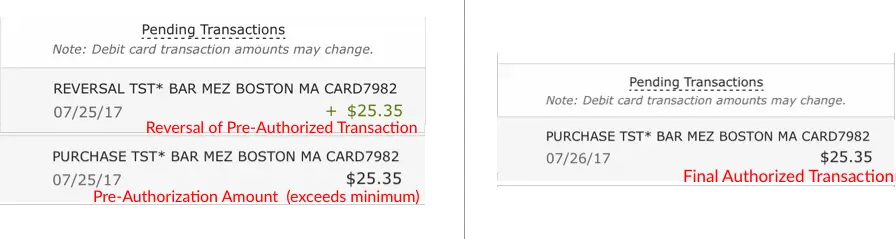

The first step in finding the TST charge on your bank statement is to review your transaction history. Look for any charges that are labeled as “TST”, “TST*”, “CR CNS TST”, “TST* PG”, “Purchase TST*” or have a similar description.

Step 2: Look for the Merchant Name

The TST charge may also include the name of the merchant or business that initiated the transaction.

If you recognize the name, it may indicate that the charge is legitimate and was made as a test to verify the validity of your card.

Step 3: Check for Other Similar Charges

Some merchants may use test charges that are not labeled as TST. Look for any charges that are small in amount and have a similar description, such as “pending authorization” or “pending transaction.”

Why Does the TST* Charge Appear on Credit Card?

The TST charge appears on a bank statement because it represents transaction fees that Toast, Inc. charges for processing payments made through its point-of-sale (POS) platform.

When customers make payments using cards on these merchant accounts through Toast’s processing system, Toast charges a transaction fee based on a percentage of the purchase amount or a flat fee for each transaction.

This fee is deducted automatically by Toast before the merchant receives the funds in their account. Therefore, when you make purchases at a merchant that uses Toast as its payment processing service, the TST charge is included on your credit card statement or bank account as a separate line item.

It’s essential to note that Toast is simply a payment processor and is not the one directly charging customers the TST fee.

The merchant is responsible for bearing the cost of Toast’s transaction fee, and subsequently, it may be passed on to the customer as the TST charge, which appears on their bank statement or credit card statement.

An MCW bank charge can lead to unauthorized debits appearing in your bank statement. Make sure you know how to handle such charges.

How to Prevent Unauthorized TST Bank Charges

Here are some measures you can take to prevent unauthorized TST bank charges:

1. Review Your Statements Regularly

One of the most efficient ways to prevent unauthorized TST bank charges is by carefully reviewing your bank statements.

If you come across TST charges that you don’t recognize or don’t remember making, it’s crucial to take action immediately. This may involve calling your bank or credit card company and informing them of the issue.

2. Protect Your Payment Information

It’s critical to keep your account and personal information safe and to avoid sharing sensitive data with third-party providers or individuals that you do not trust.

You can also enable alerts on your accounts to help flag unusual transactions and suspicious activities.

3. Check the Merchant

Before using a merchant’s services, it’s essential to do your due diligence and ensure that they are a legitimate business. Verify their credentials and reputation, read reviews, and check if they use reputable payment processing services such as Stripe or PayPal instead of lesser-known processors.

Also, review their rates, fees, and terms and conditions to identify any hidden fees or unusual practices that may lead to TST charges.

4. Monitor Your Credit Score

Monitoring your credit score is a useful way to help ensure that no one is using your information to make unauthorized transactions.

Regularly checking your credit score, ensuring that it is accurate and taking note of any changes which may indicate fraudulent activity.

By following these tips, you can help prevent unauthorized TST* charges from appearing on your bank or credit card statement.

Handling Unknown TST Credit Card Transactions

Overall, the TST charge on your credit card statement should not be a cause for alarm. It is a legitimate fee charged by Toast for payment processing when you make a transaction on a merchant account using their platform.

By being aware of what the charge is, checking merchant codes and descriptions, and keeping accurate records, you can ensure that your finances are under control and free from errors.

Handling an unknown Republic TRS charge is also easy. You just need to know what steps to take when the need arises.

Taking an active role in safeguarding your financial information can help minimize the risk of fraud, identity theft, and other financial crimes. If you do see any unauthorized charges on your statement, report them immediately to prevent any further damages.