When you check your bank statement, you may come across some unfamiliar terms, and one of them might be “Comenity Pay.” This charge can be confusing, especially if you don’t know what it is or how it got there.

In this article, we will provide you with an overview of what is Comenity Pay on your bank and credit card statement and how it appears.

What Is the Comenity Pay Bank Charge?

The Comenity Pay bank charge is a fee that appears on your bank statement for using the payment processing service provided by Comenity Pay.

This charge is usually associated with retailers or credit card companies that have partnered with Comenity Pay to provide customers with the convenience of making online or phone payments.

Although the service offers a convenient way to make payments without the hassle of visiting a physical store or calling customer service, it does come at a cost.

What Is Comenity Bank and Comenity Pay?

Comenity Bank is a financial institution that specializes in providing credit cards and other financial services to consumers in partnership with retailers and other businesses.

The bank partners with over 150 brands to offer co-branded credit cards that provide exclusive benefits to customers. Some of the well-known brands that Comenity Bank partners with include Victoria’s Secret, Wayfair, GameStop, and Petco.

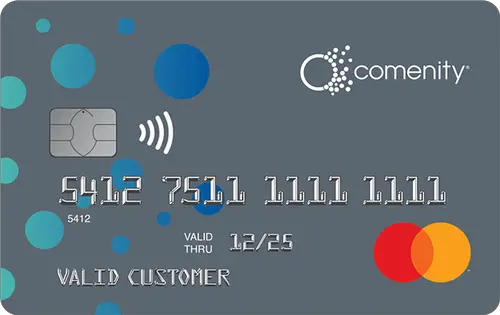

Image Credits: WalletHub

The bank has a strong focus on customer service and strives to provide its customers with a seamless and convenient banking experience.

By partnering with retailers and businesses, Comenity Bank provides customers with specialized financial products and services that cater to their unique needs and preferences.

Comenity Pay, on the other hand, is a payment processing service that enables retailers and credit card companies to manage their transactions efficiently.

The service offers customers the convenience of making payments online or over the phone, without having to visit a physical store or call customer service.

Comenity Pay is designed to make payments quick, easy, and secure, using the latest technology and encryption standards to protect customers’ financial information.

Came across a random bank charge labelled PAI ISO? Here’s how to handle it.

How Comenity Pay Charge Appears in a Bank Statement

The Comenity Pay charge appears on your bank statement as a separate line item that lists the amount charged for using the service.

This charge may appear in different ways on your bank statement, depending on the retailer or credit card company you used.

However, you can usually find it under the transaction details section, where the merchant name, transaction date, and amount are listed.

To identify the Comenity Pay charge on your bank statement, look for keywords such as “Comenity Pay,” “Comenity Payment,” “Comenity Pay BH,” Comenity Pay SB PYMT,” Comenity Pay JT,” or simply as “Comenity Charge.”

The charge may also appear with a specific retailer or credit card company name, followed by the words “Comenity Pay” or “Payment.”

Other transactions are:

- Comenity Pay BH Carter’s

- Comenity Pay NS Web Pymt

- Comenity Pay RD Web Pymt

- And the like!

A Charter Services bank charge can be an early sign of fraudulent activity in your bank account. Learn more about how you should handle this.

How to Prevent an Unauthorized Comenity Pay Charge

Here are some tips to prevent an unauthorized Comenity Pay charge:

1. Monitor Your Bank Statements Regularly

Review your bank statements frequently to identify any unauthorized charges or fees. If you notice any suspicious activity, contact your bank or credit card company immediately.

2. Keep Your Account Information Secure

Protect your account information by keeping your login credentials and personal information confidential. Avoid sharing your account information with anyone, and use strong passwords that are difficult to guess.

3. Be Cautious of Phishing Scams

Phishing scams are a common tactic used by scammers to steal personal and financial information. Be cautious of emails or messages that ask you to provide sensitive information, and only provide your information on trusted and secure websites.

4. Read the Fine Print

Before signing up for a service or making a purchase, read the terms and conditions carefully. Pay attention to any fees or charges that may apply, and make sure you understand the payment terms and cancellation policies.

5. Contact Comenity Bank

If you believe you have been charged for a Comenity Pay service you did not authorize, contact Comenity Bank directly using their phone number (1-855-823-1001) to dispute the charge. They will investigate the matter and work with you to resolve any issues.

If you ever come across an unauthorized VIOC bank charge, here’s what you need to do immediately.

Understanding Unknown Comenity Bank Charges

By following these tips, you can prevent unauthorized Comenity Pay charges and protect your financial information. Remember to always monitor your bank statements, keep your information secure, and be cautious of suspicious activity.

If you’re unsure about a particular Comenity Pay charge on your bank statement, contact your bank or credit card company to get more information.

It’s important to monitor your bank statement regularly and review your transactions to avoid any unauthorized charges or fees.

Please cancel all payment to you from my bank.