Bank charges are common among the different banking institutions handled by a financial institution. Frequently, different names, and terms can confuse customers and make them misunderstand; what these charges are.

One of the particular bank charges that cause confusion is the “COMN CAP APY F1 Charge.”

In the sections below, we will discuss what COMN Cap APY F1 charge is on your bank statement and give insights on how to identify it and preventing it from appearing again.

What Is the COMN Cap APY F1 Bank Charge?

The COMN CAP APY F1 Charge is a charge that financial institutions apply to customer accounts for several reasons. Primarily, it happens when your account is not active for a specified period.

The charge may vary from one financial institution to another, and at times, it may include additional taxes or fees that a customer may be required to pay.

Most banks also add an Annual Percentage Yield (APY) interest rate to the charges, which could increase the cost of the charge.

It’s important to note that this charge is not limited to dormant accounts; it can also be applied to accounts that maintain a minimal balance.

Therefore, customers should regularly review their accounts’ activities to identify any activities that might attract this charge.

You can also find a similar charge labelled EBT Account Check on your statement. Here’s what you should do if you do find it.

APR vs. APY: The Difference

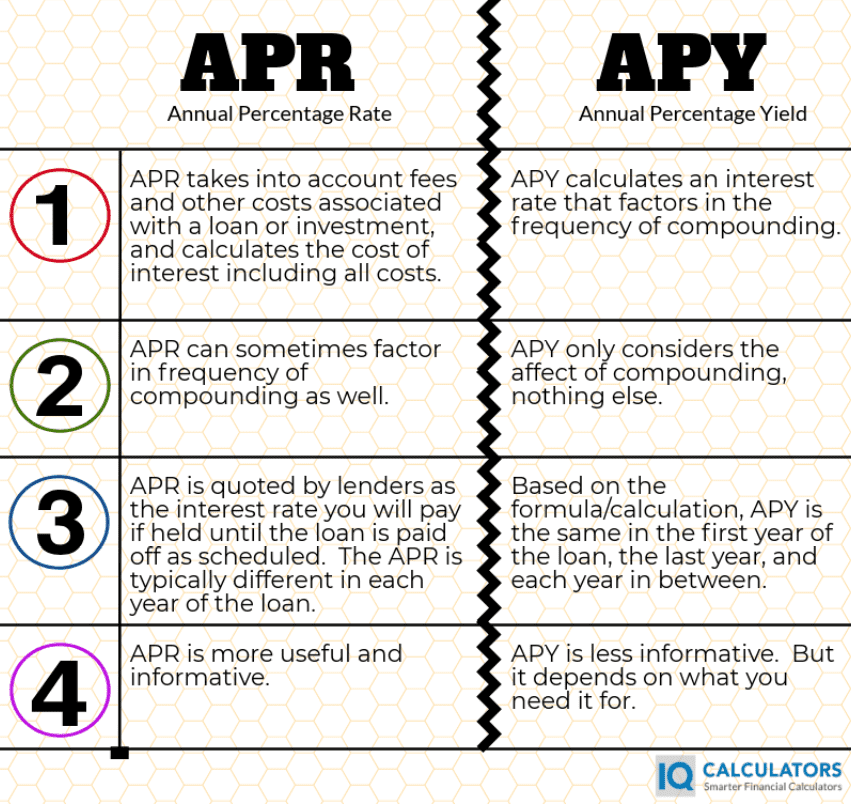

APR and APY both refer to the interest rate associated with various financial products, such as loans, savings accounts, and credit cards. However, APR and APY are not the same, and the primary difference lies in how these interest rates are calculated.

APR stands for “Annual Percentage Rate.” It is the flat rate used to calculate interest on loans or credit card transactions.

APR typically refers to the interest rate charged on a specific amount borrowed, excluding compounding interest. Lenders and credit card companies use APR to calculate how much interest borrowers pay on their loans or credit card balances over a year.

On the other hand, APY stands for “Annual Percentage Yield.” It refers to how much interest a financial institution pays on deposits (such as savings accounts or certificates of deposit) over a year, including compound interest.

APY considers the interest earned on the account, the frequency of interest rates being compounded, and the account’s fees.

Therefore, the primary difference between APR and APY is that APR is typically used for loans and credit cards and calculates the interest charged on money borrowed, whereas APY is mostly used for savings accounts and calculates the interest earned on money deposited.

How Does COMN Cap APY F1 Appear on a Bank Statement

To find out whether the COMN CAP APY F1 charge is present in your bank statement, review your bank account’s activities.

The COMN CAP APY F1 Charge is usually recorded in the fees section of your bank statement and labeled as ”Common CAP APY F1 Charge,” “COMN CAP APY F1 Autopay PPD ID,” or just “CAP APY F1.”

Additionally, the charge can appear after a specified duration of inactivity, usually ranging from three months to a year, depending on the institution.

Came across a bank transaction with the name FBPay? Here’s what you need to know.

How to Handle the COMN CAP APY F1 Charge

To prevent the COMN CAP APY F1 charge from appearing again, customers should ensure they regularly maintain a minimum account balance and engage with their bank activities frequently.

They can also contact their bank’s customer service for clarification on the charge and possible strategies that can help prevent this charge from appearing on their bank statements.

Some financial institutions may waive or reverse the charges, especially if it was incurred due to unforeseen circumstances affecting the account activity.

Alternatively, customers can request their banks to switch to accounts with lower fees or waive the monthly fees in exchange for meeting specific qualifications, such as a minimum account balance or deposit amount.

Customers can also opt to close their unused accounts to avoid dormant account fees.

The steps for handling other unknown bank transactions, the SEI charge for instance, are more or less the same.

Understanding the COMN CAP Apy F1 Charge

In conclusion, the COMN CAP APY F1 Charge can be confusing to banking customers who have never encountered it before. However, by understanding what the unknown charge is, how to identify it, and prevent it from appearing again, customers can avoid incurring unnecessary charges on their bank account.

You can also find a similar charge on your credit card statement labelled Comenity APY f2 auto pay.