Curious about that “Dave Inc” charge on your bank statement? You’re not alone. Many folks have been scratching their heads over this unexpected fee, and we’re here to shed some light on what’s going on.

You might have encountered this mysterious charge from Dave, which is associated with Dave.com, a digital banking service that specializes in cash advances.

Don’t worry, we’ve got you covered with a breakdown of what the Dave.com Inc. charge is, how to identify it, and steps to prevent it from catching you off guard in the future.

What Is the Dave.com Bank Charge?

This charge is intimately connected with Dave.com, a digital banking service that has garnered attention for its distinctive take on cash advances.

Unlike the conventional overdraft fees that often leave us scratching our heads, Dave operates on a different ethos—one that revolves around tips and subscription fees rather than penalizing you for financial slip-ups.

Dave, let’s be clear, isn’t just another name in the financial landscape; it’s an innovative player that aims to redefine how we manage our money.

It isn’t a traditional bank, yet it offers you a bank account experience through a strategic partnership with Evolve Bank & Trust.

The significance? Your deposits are in safe hands, backed by the federal government’s FDIC insurance up to $250,000. But what about the charges and fees that seem to be at the heart of the matter?

The Dave Mastercard debit card is more than just a piece of plastic. It comes with Zero Liability Protection, a reassuring feature that shields you from the burden of “unauthorized transactions.”

This safeguard applies across various transaction modes—whether you’re swiping in a store, making online purchases, or conducting ATM transactions.

In the unfortunate event that your card goes missing or suspicious activities pop up, swift reporting to Dave can help you avoid any liabilities stemming from unauthorized transactions.

But here’s where the waters might get a bit murkier. When you explore Dave’s website or app, you’ll notice a landscape adorned with footnotes, disclaimers, and fine print. Unlike some of its competitors that loudly proclaim “No hidden fees,” Dave takes a more nuanced approach.

Yes, the fees are there, but they might not be immediately transparent. The concept of obtaining a $250 cash advance with no interest and no fees sounds enticing, but there’s more to it than meets the eye.

The fine print becomes clearer when you’re a Dave subscriber. To access those appealing cash advances, you’ll need to pay a monthly fee of $1. This subscription is your key to the benefits of Dave’s offerings.

An important point to note—deleting the app alone won’t extricate you from this recurring fee; it’s essential to cancel your Dave account if you wish to halt the charges. It’s a bit of a dance between financial convenience and the cost associated with it.

Is the Dave Inc Charge a Scam?

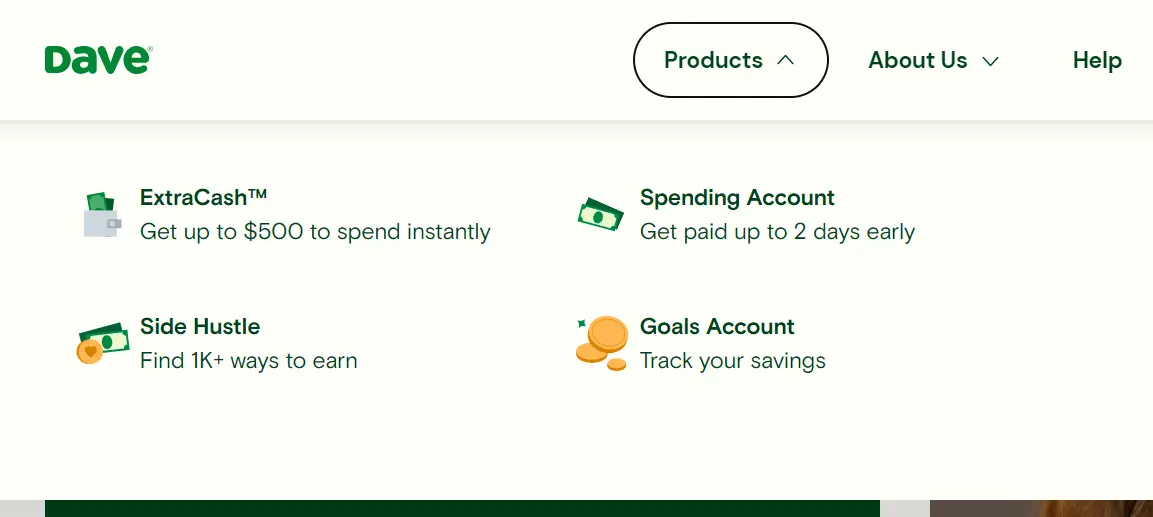

In the realm of pros and cons, Dave shines with cash advances that don’t carry interest or fees, and there’s no credit check required. Additionally, the app extends its utility beyond banking, offering automatic budgeting features and links to side jobs for some extra income.

On the flip side, the cost of membership might raise an eyebrow, and Dave has been known to automatically recoup advances if repayment deadlines are missed.

It’s worth noting that while Dave offers convenience, it comes with certain limitations—like a relatively modest maximum advance of $250.

Dave.com, with its cash advances, subscription model, and innovative debit card features, is at the forefront of reimagining how we manage our finances.

While the specifics of the charge might seem intricate, understanding them empowers you to make informed decisions about your financial journey.

As you continue navigating this terrain, remember that being in the know is your strongest tool against unexpected financial twists and turns.

Unraveling the mystery behind “LPS” entries on your bank statement involves delving into their significance to make informed financial decisions.

How Does the Dave Inc. Bank Charge Look Like?

When you’re reviewing your bank statement and trying to spot that elusive “Dave Inc” bank charge, it’s essential to know what to look for.

Here’s a breakdown of the transaction entries that might appear on your bank statement:

- Debit Card Purchase – Dave Inc.

- POS Transaction – Dave Inc.

- Electronic Funds Transfer – Dave Inc.

- ACH Transaction – Dave Inc.

- Online Payment – Dave Inc.

- Dave Inc. Transaction

- Card Payment – Dave Inc.

- ATM Withdrawal – Dave Inc.

- Point of Sale – Dave Inc.

- Transfer – Dave Inc.

Remember, these entries might vary slightly depending on your bank’s terminology, but these are the common types of transaction entries associated with the “Dave Inc” charge.

When deciphering your bank statement, comprehending transactions labeled “Ikano Bank” can offer valuable insights into your financial activities.

How to Prevent Unauthorized Dave.com Bank Charges

Navigating the realm of digital banking requires vigilance and awareness, especially when it comes to preventing unauthorized charges that might catch you off guard.

If you’ve spotted an unfamiliar “Dave Inc” charge on your bank statement, here are some practical steps you can take to safeguard your financial well-being.

1. Regular Statement Scrutiny

Engage in the habit of reviewing your bank statements regularly. This simple practice enables you to detect any unauthorized transactions promptly.

Keep an eye out for any “Dave Inc” charges that you don’t recognize. If something seems amiss, don’t hesitate to investigate further.

2. Reporting and Disputing the Dave Inc. Charge

Should you stumble upon a “Dave Inc” charge that doesn’t align with your financial activity, don’t delay in taking action. Reach out to your bank’s customer service immediately to report the unauthorized charge.

Most financial institutions have a process for disputing such transactions, and your proactive approach can help you reclaim your funds.

3. Financial Institution Alert Services

Many banks offer alert services that notify you of transactions via email or text. Enabling these alerts can serve as an effective tool in detecting unauthorized activity in real-time.

If a “Dave Inc” charge pops up unexpectedly, you’ll be notified right away, allowing you to act swiftly.

4. Secure Your Personal Information

Preventing unauthorized charges starts with safeguarding your personal information. Use strong, unique passwords for your online banking and financial accounts.

Consider enabling two-factor authentication, which adds an extra layer of security by requiring a second form of verification.

5. Maintain Open Communication

If you encounter unauthorized charges, don’t hesitate to engage in a dialogue with your bank. Their expertise can guide you through the process of disputing charges and recovering any lost funds.

Clear communication with your bank ensures that you’re not navigating these challenges alone.

6. Limit Third-Party Access

When using financial apps like Dave, be cautious about granting access to your bank accounts. Only authorize apps from reputable sources that adhere to strict security protocols.

Check app permissions regularly and revoke access for any apps that you no longer use or trust.

If you’re puzzled by entries like Home Retail Group on your bank statement, understanding their origins is crucial for maintaining financial clarity.

Understanding Unknown Dave Inc Bank Charges

In conclusion, that “Dave Inc” charge on your bank statement is connected to the Dave app, a digital banking service offering cash advances and innovative financial solutions.

While the charge might catch you off guard, now you have the knowledge to identify it, understand its origins, and take steps to prevent it from recurring. Remember, financial security is a priority, and staying informed is your best defense against unexpected surprises.