Have you ever come across the abbreviation “LPS” on your bank statement and wondered what it signifies? Fear not, for in this article, we’ll delve into the dual meanings of LPS and shed light on the possible charges associated with it.

By the end of this guide, you’ll not only understand the origins of the LPS charge on your bank statement but also be equipped with the knowledge to identify and manage it effectively.

What Is the LPS Bank Charge?

The LPS bank charge can be attributed to two distinct interpretations, each with its own implications.

Land and Property Services

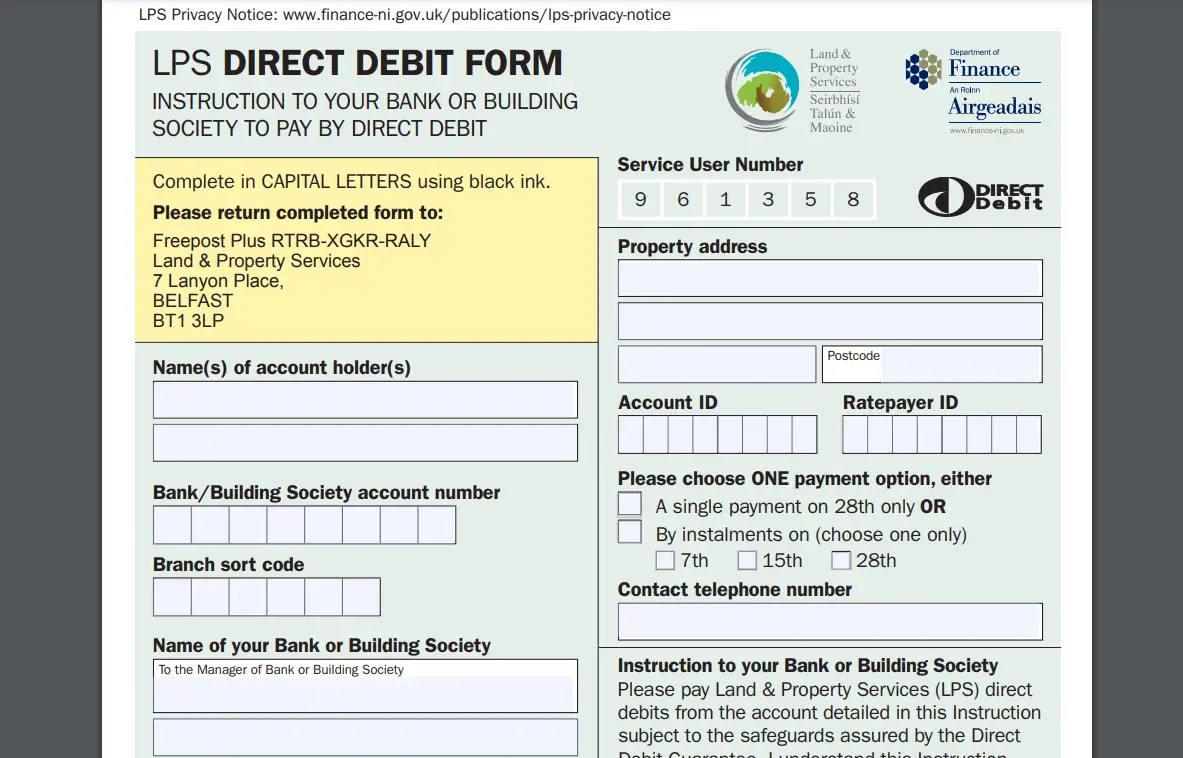

Firstly, it can refer to Land and Property Services, a department that facilitates the automated payment of your rates bill through Direct Debit.

This convenience allows you to streamline your financial obligations and avoid the hassle of manual payments. By establishing a Direct Debit arrangement with LPS, you authorize them to deduct the required amount from your designated bank or building society account.

This automated approach not only saves you time and effort but also helps prevent missed payments and associated penalties.

Loyaltek

On the other hand, the LPS bank charge might also relate to transactions involving Loyaltek, a provider of payment terminals widely used by various businesses such as shops, hotels, restaurants, and medical professionals.

If your statement suggests a connection to Loyaltek, it’s advisable to seek further clarification from your bank. Understanding whether the charge is linked to Land and Property Services or Loyaltek is pivotal in comprehending the nature of the expense.

To effectively navigate the impact of the LPS bank charge, it’s essential to discern its origin and purpose. If it pertains to Land and Property Services, you’ve likely taken a proactive step toward managing your rates bill by opting for automated payments.

Ensuring the accuracy of the information you provide to LPS, such as your ratepayer ID, account ID, and bank details, is key to a seamless Direct Debit setup.

Conversely, if the charge is linked to Loyaltek, it signifies transactions processed through their payment terminals by merchants. This could encompass anything from retail purchases to dining experiences.

To understand the entry FirstOnline on your bank statement, delve into its significance and implications.

How Do LPS Charges Appear on Bank Statements?

LPS charges can appear on your bank statement in various ways, depending on the nature of the transaction. Whether it’s related to Land and Property Services or involves payments through Loyaltek terminals, deciphering these entries will empower you to manage your financial affairs proactively.

Transaction Entries on Your Bank Statement:

- LPS Automated Payment – Rates Bill

- LPS Direct Debit – Property Tax

- LPS Transaction – Automated Payment

- LPS Charge – Property Rates

- Loyaltek Transaction – Merchant Name

- LPS Payment – Direct Debit

- LPS Fee – Service Charge

- Loyaltek Purchase – Transaction Date

- LPS Deduction – Automated Payment

- LPS Debit – Land and Property Services

By familiarizing yourself with the various transaction entries associated with LPS charges, you can effortlessly identify these expenses on your bank statement.

If you spot Home Retail Group on your bank statement, unravel its context and implications here.

How to Prevent Unknown LPS Bank Charges

Preventing unknown LPS bank charges is essential to maintaining a streamlined financial journey.

By implementing vigilant practices and staying informed, you can safeguard yourself from unexpected expenses and ensure a more secure financial landscape.

1. Thoroughly Review Your Bank Statements

Regularly scrutinizing your bank statements serves as a primary defense against unknown LPS charges. Take time to examine each entry, ensuring you recognize and can account for every transaction.

If any LPS-related charge appears unfamiliar, don’t hesitate to investigate further.

2. Understand LPS Charge Descriptions

A key strategy to prevent unknown charges is to familiarize yourself with common LPS charge descriptions.

By understanding how LPS charges are typically denoted on your bank statement, you can quickly identify legitimate expenses and spot any anomalies.

3. Keep Communication Lines Open

Maintaining an open line of communication with your bank is paramount. If you notice any suspicious or unexplained charges, promptly contact your bank’s customer service.

They can provide clarity on the charge’s origin and help you take appropriate action.

4. Validate Direct Debit Arrangements

If you’ve set up Direct Debit arrangements with LPS for automated payments, periodically verify the transaction details.

Ensure the deducted amounts match your expectations and that the charges align with your rates bills.

5. Monitor Merchant Transactions

Stay vigilant when making purchases through merchants using Loyaltek terminals. Review the receipts and transaction details to confirm that the charges correspond to your actual transactions.

If discrepancies arise, address them promptly with your bank.

6. Utilize Alerts and Notifications

Leverage your bank’s notification features to receive real-time updates about transactions. Alerts can help you stay on top of any LPS-related charges and address any potential issues promptly.

Understanding Unauthorized LPS Bank Charges

Whether it refers to Land and Property Services or Loyaltek, your newfound knowledge empowers you to identify, understand, and take charge of the charges.

By embracing automation, accuracy, and a proactive approach, you’re well on your way to a smoother financial journey.

Decode the presence of Ikano Bank on your bank statement and gain insights into its meaning and relevance.