Have you ever seen a bank charge on your statement and wondered what it was, only to find it was labeled “MSFT?” Seeing an unfamiliar MSFT charge on your bank statement can be worrying, but don’t worry; it’s just a charge from Microsoft for using their services.

In this article, we’ll explain everything you need to know about the MSFT charge on your bank statement.

What Is the MSFT Bank Charge?

The MSFT bank charge is a deduction from your bank account that is often associated with Microsoft services. Microsoft offers a wide range of services that can result in MSFT bank charges, including Office 365, Azure, Xbox, and more.

The MSFT bank charge is typically a recurring payment that is automatically debited from your bank account based on the agreed payment schedule when you subscribed to Microsoft’s services.

The charge is entirely legal and authorized if you have previously subscribed to Microsoft’s services and provided your payment details as required.

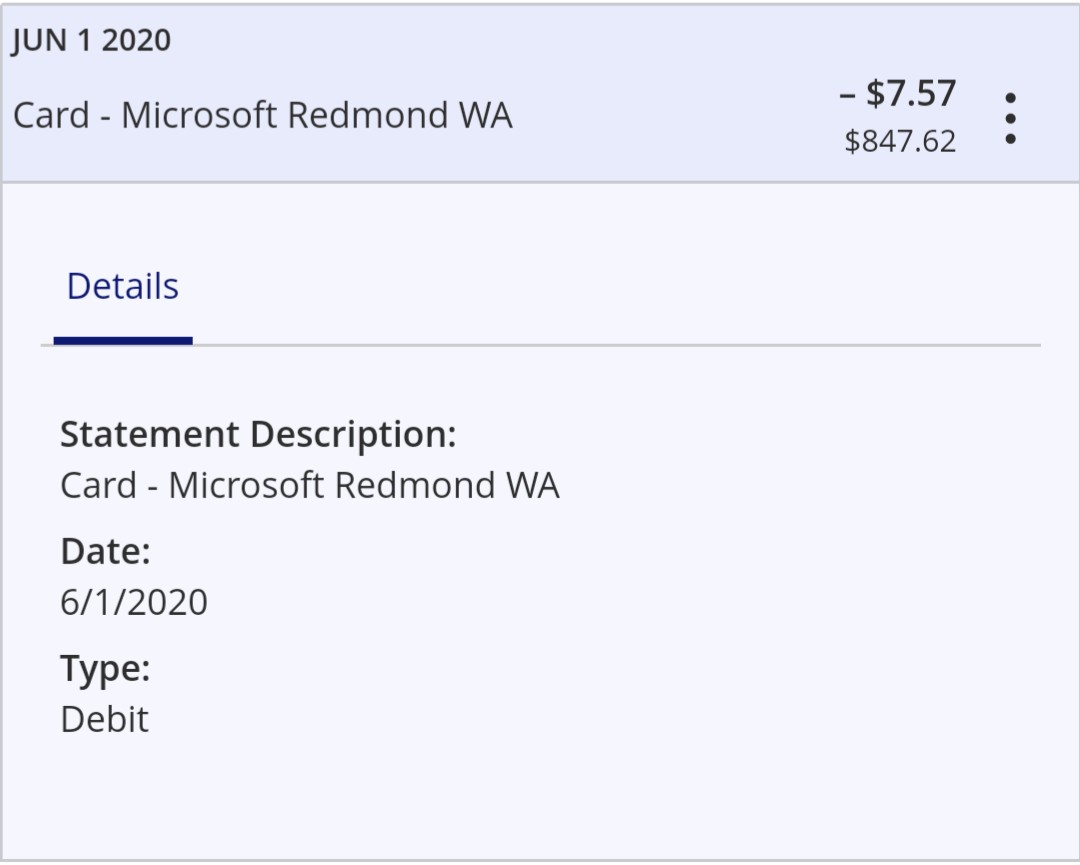

Image Credits: Ask Microsoft

It is worth remembering that while the MSFT bank charge does not necessarily mean an unauthorized transaction, it can also result from a mistake or fraudulent activity. Review your bank statements regularly to ensure that the charges are accurate and reflect the services you have agreed to pay for.

Furthermore, be aware that scammers may also use the MSFT abbreviation or any other related Microsoft words to fool or deceive you. They may charge into your bank account for services you never subscribed to or didn’t realize you were subscribing to.

If you find a legitimate MSFT bank charge that you no longer want to pay along the line, you can cancel the service subscription. Besides, Microsoft provides clear instructions on how to cancel subscriptions on their website, which you can follow to cancel any unwanted services.

If you find an unauthorized MMBILL.COM charge on your credit card statement, it’s important that you know how to handle it.

How MSFT Appears on a Bank Statement

When a transaction is made for Microsoft services and debited from your bank account, it may appear on your bank statements as “MSFT.” The labeling may vary slightly based on the banking institution or payment provider.

The “MSFT” abbreviation can be confusing, appearing vague or mysterious at first glance. However, it is essential to identify and reconcile it with the actual Microsoft services you subscribed to and prevent unauthorized transactions.

Here is a list of transactions that can cause an MSFT bank charge:

- Subscription fees for Microsoft Office products such as Microsoft 365, Office 365, OneDrive, Exchange Online, SharePoint Online, and more.

- Charges for access to Microsoft Azure services, which include cloud computing, storage, databases, analytics, and other enterprise services offered by Microsoft under the Azure brand.

- Costs for purchasing or upgrading Microsoft Windows applications or operating systems such as Windows 10.

- Payments processed for Xbox game consoles, Xbox Live subscriptions, and other digital Xbox offerings.

- Fees associated with specific Microsoft software products or services like Microsoft Dynamics CRM, Power BI, or PowerApps.

It’s essential to match the transactions listed above with your activity to check for fraud and prevent any unintentional, recurrent expenditure.

- microsoft*store msbill.info

- MSFT *ONLINE BILL.MS.NET WAUS

- Microsoft corp Redmond WA

By identifying each MSFT deduction and understanding the services they represent, you can take control of your finances and avoid unnecessary charges.

Moreover, if you’re unsure about a specific “MSFT” transaction on your bank statement, you can contact the Microsoft support team for clarification and further assistance. They may be able to provide additional details and insights into the transaction and the associated Microsoft service

A MEPCO charge on your bank statement can be part of a scam. Here’s what you should do if it appears on your statement.

How to Prevent Unauthorized MSFT Bank Charges

Bank charges for Microsoft services can add up over time, which is why it’s essential to prevent unauthorized MSFT bank charges. Here are some steps you can take to protect yourself from fraudulent and accidental MSFT charges on your bank statement:

1. Protect Your Payment Information

Ensure that your payment information, such as bank account or credit card details, are kept secure and not shared with unauthorized third parties.

2. Monitor Your Bank Statements Regularly

Check your bank account regularly to review your transactions, including MSFT charges, and confirm that they are authorized and accurate.

3. Cancel Subscriptions for Services You No Longer Need

Remove services subscriptions that are no longer necessary to avoid recurring payments and unspecified charges.

4. Set Up Alerts

Many banks offer account alerts that notify you when any bank transactions occur within your account. You can set up such an alert to notify you of any MSFT charges made, which may help you catch any fraudulent transactions early.

5. Enable Two-Factor Authentication

Enable two-factor authentication for your Microsoft account and bank account to add an extra layer of security when logging in and conducting financial transactions.

6. Be Aware of Scams

Be aware of scams that may be orchestrated to obtain your payment information. Verify any emails or messages sent to you before providing any personal or financial information.

Here’s how you should handle an unauthorized Probiller charge on your statement.

Understanding Unsolicited MSFT Bank Charges

The MSFT bank charge refers to payments made for Microsoft services, including Office 365, Azure, Windows applications, Xbox products, and more.

Knowing how MSFT appears on your bank statement will help you keep better track of your finances and prevent any unauthorized transactions.