Did you just find a random bank transaction with the name “NWEDI” in your credit card or bank statement? This might have lead you to worry about unauthorized usage on your debit card or bank account.

But don’t worry. We’ll explain exactly what NWEDI is on a bank statement and highlight the possible reasons for the charge appearing on your statement.

What Is NWEDI?

NWEDI, also known as Nationwide EDI payment, refers to the Electronic Data Interchange payment system used by Nationwide Building Society, one of the largest financial institutions in the United Kingdom.

Electronic Data Interchange (EDI) is a standardized electronic communication method that allows businesses and organizations to exchange business documents, such as purchase orders, invoices, and payments, in a structured and automated manner.

Nationwide, like many other organizations, uses the NWEDI system to streamline their payment processes and improve efficiency.

By adopting EDI technology, Nationwide can electronically transmit payment instructions and related information to their business partners, vendors, and suppliers, allowing for seamless and secure transactions.

With NWEDI, Nationwide Building Society is able to automate payment processes, reduce paperwork, minimize errors, and expedite payment settlements.

This system provides a fast, reliable, and accurate method of exchanging payment data between Nationwide and their network of business associates.

For businesses, incorporating NWEDI into their payment workflows can offer numerous benefits. These may include faster transaction processing times, improved accuracy in payment data, reduced manual intervention, enhanced security through encryption and authentication measures, and increased efficiency by eliminating the need for paper-based documentation and manual reconciliation.

It is important to note that NWEDI is specific to Nationwide Building Society, and other financial institutions may use different systems or variations of EDI for their electronic payment processes.

However, the overarching aim of these systems is to simplify and optimize payment transactions through electronic means.

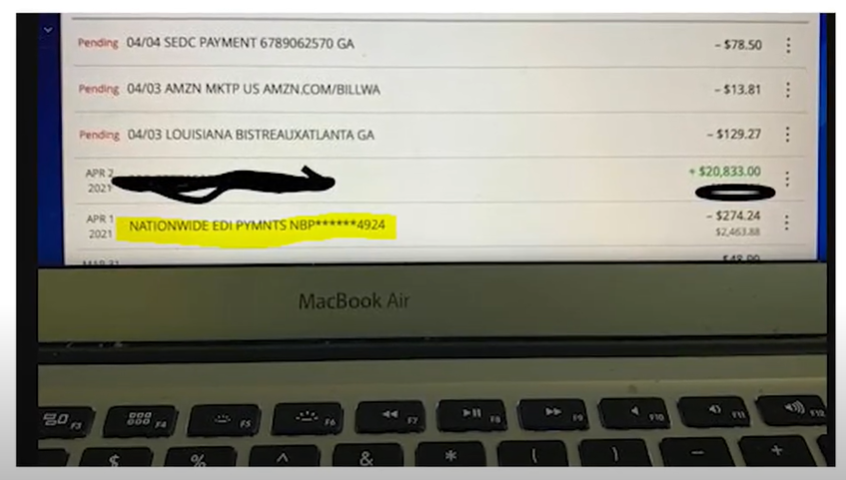

How Does the NWEDI Charge Appear?

The NWEDI charge on your bank statement may appear in different ways, depending on how your bank labels transactions. Here is a bulleted list of possible ways the NWEDI charge may be displayed:

- NWEDI Payment

- Nationwide EDI Payment

- NW EDI Charge

- NWEDI Transaction

- Nationwide Building Society EDI

- NW Charge

- NW Payment

- Nationwide Electronic Payment

- NWEDI Fee

- NWEDI Service Charge

- Nationwide Electronic Data Interchange

Please note that the exact description may vary depending on your specific bank and their formatting preferences for transaction labels.

It’s essential to carefully review your bank statement and search for any transaction descriptions that contain references to NWEDI, Nationwide Building Society, or Electronic Data Interchange to identify the charge accurately.

How to Prevent NWEDI Charges From Appearing Again

To prevent NWEDI charges from appearing on your bank statement in the future, here are some proactive steps you can take to safeguard your finances and minimize the likelihood of unauthorized charges:

1. Regularly Review Your Bank Statements

Stay vigilant by reviewing your bank statements regularly. Look for any unfamiliar charges, including NWEDI-related transactions. Report any unauthorized charges to your bank immediately.

2. Keep Your Payment Information Secure

Safeguard your payment cards and sensitive financial information. Only provide your card details on secure and reputable websites. Be cautious of phishing attempts and avoid sharing your information over unsecured platforms.

3. Protect Your Personal and Account Information

Be mindful of sharing personal or account information, especially when interacting with unknown individuals or companies. Verify the legitimacy of requests before providing any sensitive details.

4. Utilize Strong Passwords

Use strong and unique passwords for your online banking and payment accounts. Avoid using easily guessable information and consider adopting a password manager to enhance security.

5. Enable Transaction Notifications

Take advantage of alerts and notifications offered by your bank. Set up alerts to receive updates on account activity, including transactions above a certain threshold. This way, you can quickly identify any suspicious or unauthorized NWEDI charges.

6. Exercise Caution With Electronic Interactions

Be cautious when sharing information online or responding to emails, calls, or messages regarding your financial or banking activities. Verify the authenticity of communications before sharing any personal or financial details.

7. Contact Your Bank

If you notice any unauthorized NWEDI charges or suspect fraudulent activity, reach out to your bank immediately. They can assist you by blocking your card, investigating the charges, and providing further guidance on preventive measures.

By implementing these preventive measures, you can reduce the risk of NWEDI charges and enhance the security of your financial transactions.

Understanding Unknown NWEDI Bank Charges

All in all, you should know each and every transaction listed in your bank statement, whether it’s NWEDI payments or an unknown charge labelled XYZ.

It’s a good habit to periodically check your bank statement, to make sure no unauthorized or unsolicited transaction like the SQ charge slips past you.