Ever noticed “VF Northern Europe” listed on your bank statement and wondered what it signifies? Whether you’re a retail aficionado, outdoor enthusiast, or someone who simply values financial clarity, understanding these entries is crucial.

In this article, we’ll unravel the mystery behind “VF Northern Europe” on your bank statement, helping you navigate these transactions with confidence.

Just as VF Northern Europe Ltd. efficiently distributes clothing and accessories, let’s explore how we can efficiently manage our financial transactions.

What Is the VF Northern Europe Bank Charge?

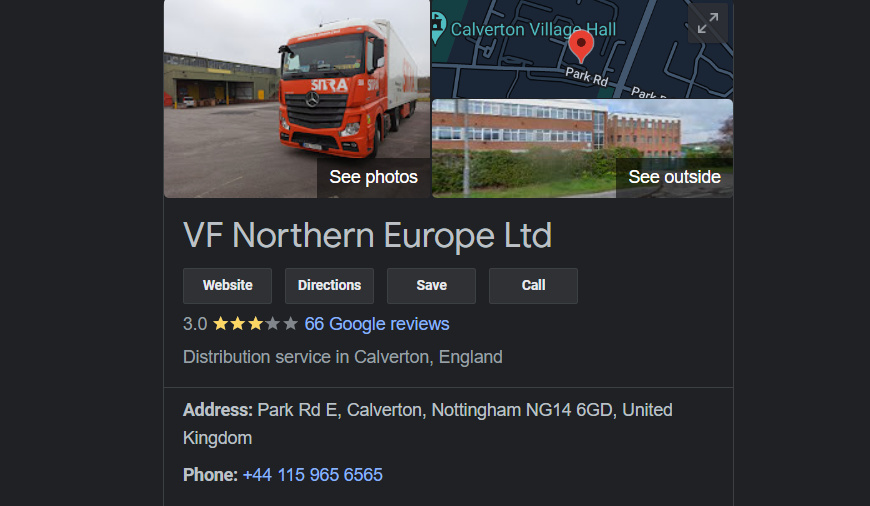

The VF Northern Europe bank charge, often listed in your statement, is a fee associated with transactions related to VF Northern Europe Ltd., a prominent player in the distribution of clothing and accessories.

With a dedicated focus on providing sales support within the realms of apparel, outdoor activity, and footwear sectors, VF Northern Europe Ltd. ensures its products reach customers across the United Kingdom and Republic of Ireland.

Likewise, the bank charge represents the financial interaction resulting from purchases made within these sectors.

This charge, while seemingly enigmatic at first, aligns with the same principle of financial transparency that VF Northern Europe Ltd. upholds in its distribution practices.

Just as VF Northern Europe Ltd. values delivering quality products, understanding the implications of the VF Northern Europe bank charge contributes to maintaining your financial clarity.

Whether you’re an individual consumer or a business entity, unraveling the intricacies of this charge empowers you to make informed decisions and manage your financial resources efficiently.

Learn about the appearance of Amazon Digital entries on your bank statement and understand their significance in your financial transactions.

How Does the VF Northern Europe Charge Look Like?

When it comes to spotting the VF Northern Europe charge on your credit card or bank statements, it’s essential to be familiar with the various transaction entries that might appear.

Here’s a list of these entries that you might encounter:

- VF Northern Europe Ltd.

- VF North EU Bank Charge

- VFN Europe Transaction

- VFNE Payment

- VF Northern Europe Fee

- VF Northern EU Debit

- VF North Euro Transaction

- VFNE Ltd. Purchase

- VFNE Withdrawal

- VF Northern Europe Debit

- VF North EU Transaction

- VFNE Ltd. Fee

- VF Northern Europe Purchase

- VFNE Ltd. Debit

As you review your bank statement, keep an eye out for any of these entries. These transaction records correspond to your interactions with VF Northern Europe Ltd., whether it’s a purchase, fee, withdrawal, or other financial activities within the clothing, accessories, outdoor activity, and footwear sectors.

Familiarity with these entries ensures that you can easily identify the VF Northern Europe charge and keep track of your financial transactions effectively.

Discover the implications behind TFL Business BOps entries that appear on your bank statement and gain insights into their relevance to your financial activities.

How to Prevent Unauthorized VF Northern Europe Charge

Ensuring the security of your financial transactions is paramount, especially in the context of the VF Northern Europe charge. Unauthorized charges can disrupt your financial stability and cause unnecessary stress.

Let’s explore how you can safeguard yourself against such situations.

1. Regular Account Monitoring

By consistently monitoring your bank statements, you establish a proactive defense against unauthorized VF Northern Europe charges.

Regularly reviewing your transactions allows you to spot any unfamiliar or suspicious entries promptly. This vigilance enables you to address any discrepancies before they escalate into more significant issues.

2. Contacting Your Bank

Maintaining open communication with your bank is a crucial step in preventing unauthorized VF Northern Europe charges. If you notice any unfamiliar or suspicious activity related to VF Northern Europe transactions, promptly contact your bank’s customer service.

They can provide insights into the transactions and guide you on necessary actions to take, such as freezing the account or initiating a dispute.

3. Utilizing Two-Factor Authentication

Incorporating two-factor authentication (2FA) for your online banking and payment platforms adds an extra layer of security. This additional verification step ensures that only you can authorize transactions related to VF Northern Europe or any other entity.

By requiring both a password and a secondary verification code, you reduce the risk of unauthorized access to your accounts.

4. Regularly Updating Passwords

Maintain the habit of regularly updating your online banking and account passwords. This practice minimizes the chance of unauthorized individuals gaining access to your financial information.

Ensuring that your passwords are strong, unique, and not easily guessable is an effective way to prevent unauthorized charges.

5. Keeping Software Updated

Updating your devices and software regularly, including operating systems, browsers, and security software, is a crucial aspect of digital security.

Outdated software might have vulnerabilities that can be exploited by cybercriminals. By staying up to date, you reduce the risk of unauthorized access to your financial data, thereby safeguarding against unauthorized charges.

6. Being Cautious Online

Exercise caution while engaging in online transactions and sharing personal information. Avoid clicking on suspicious links, and only use secure and reputable websites for purchases.

Scammers can use phishing tactics to gather your information, potentially leading to unauthorized charges. Staying vigilant and cautious while online can help prevent falling victim to such scams.

Explore the details behind PayPal Inst Xfer entries on your bank statement, unraveling their connection to your financial transactions and broader financial landscape.

Understanding Unknown VF Northern Europe Charges

In conclusion, “VF Northern Europe” entries on your bank statement aren’t enigmas but rather reflections of your interactions with a company that values quality in distribution.

By understanding, identifying, and proactively addressing these entries, we ensure that our financial journey is as seamless as the distribution operations of VF Northern Europe Ltd. Remember, clarity in transactions leads to clarity in financial goals.