If you’ve ever noticed an unfamiliar charge on your bank statement from “WW Int’l-DIGITAL 800-221-2112,” you might be wondering what it’s all about.

Don’t worry; we’ve got you covered. In this article, we’ll delve into what the WW Int’l-DIGITAL 800-221-2112 charge on your bank statement is, how to identify it on your statement, and most importantly, how to prevent it from appearing again in the future.

What Is the WW Int’l-DIGITAL 800-221-2112 Bank Charge?

The WW Int’l-DIGITAL 800-221-2112 bank charge is a transaction that may appear on your bank statement, catching you by surprise and sparking curiosity about its origin and purpose.

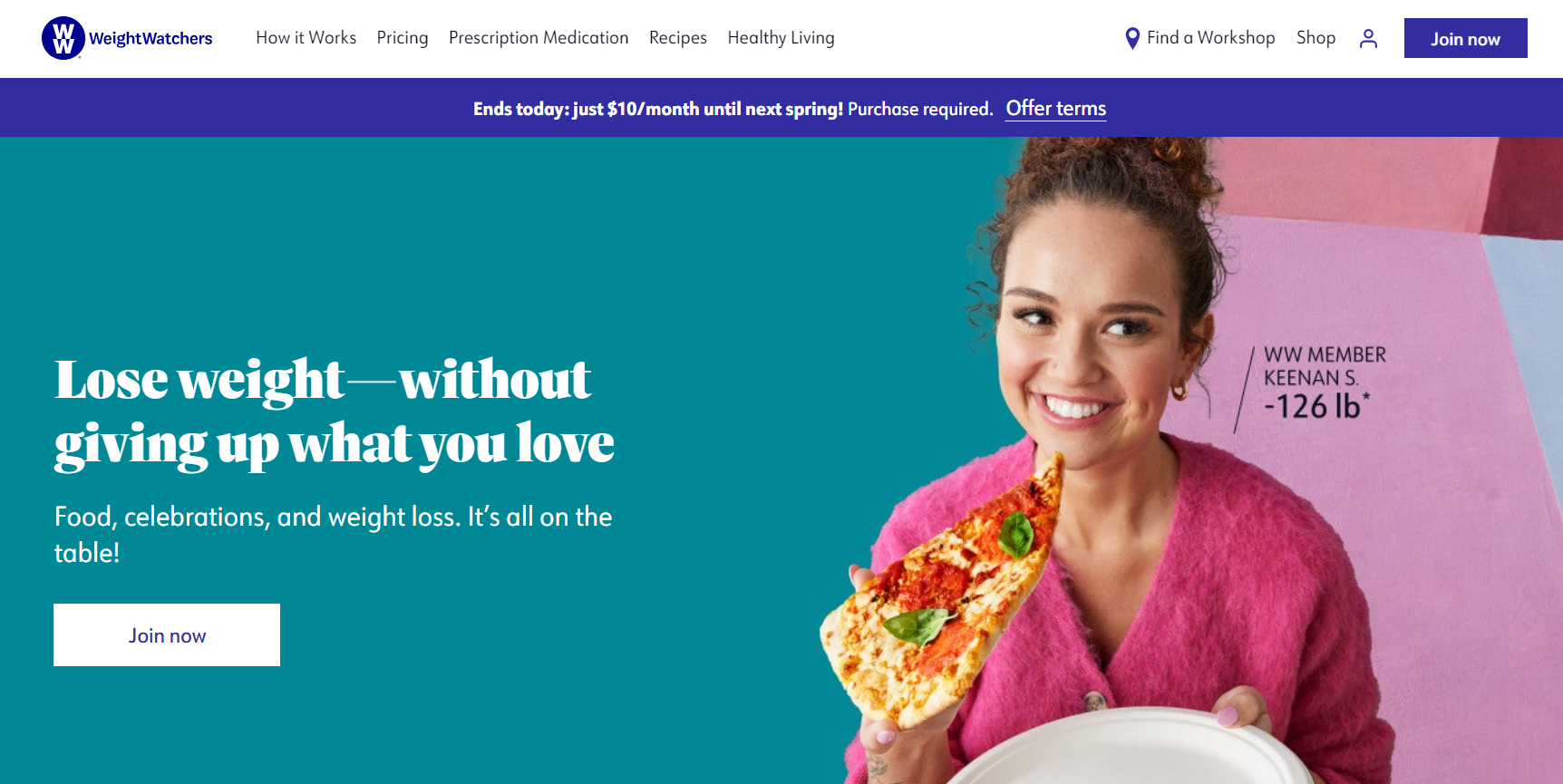

This charge is commonly associated with Weight Watchers, a well-known company focused on providing weight management and wellness services.

While for some, this charge may represent a legitimate purchase or membership fee, for others, it can be a cause for concern, as it might be an unauthorized or fraudulent transaction.

When you come across the WW Int’l-DIGITAL 800-221-2112 bank charge, it is essential to investigate its authenticity promptly. If you have an active association with Weight Watchers, such as an ongoing membership or a recent purchase, there is a possibility that this charge is legitimate.

In such cases, you can put your mind at ease, knowing it’s a valid transaction related to their products or services.

However, it is not uncommon for individuals to encounter this charge without any direct involvement with Weight Watchers. In such instances, it is vital to be vigilant and treat it as a potential fraudulent activity.

Unauthorized charges can result from various sources, such as data breaches, phishing scams, or identity theft. Discovering such an unexpected charge may prompt you to question your account’s security and prompt you to take appropriate action to safeguard your financial information.

How Does the WW Int’l-DIGITAL 800-221-2112 Charge Appear?

On a bank statement, the WW Int’l-DIGITAL 800-221-2112 charge may appear in various ways, depending on the bank’s format and the level of detail provided.

Here’s a bulleted list of possible transaction entries that could represent the charge:

- WW Int’l-DIGITAL 800-221-2112 – $19.95

- WW Int’l-DIGITAL 800-221-2112 – $20.95

- WW Int’l-DIGITAL 800-221-2112 – $19.95

- WW Int’l-DIGITAL 800-221-2112 – $20.95

- WW Int’l-DIGITAL 800-221-2112 – $19.95

Please note that the exact formatting and description of the transaction may vary based on the bank’s system, so the entries might appear differently on your specific bank statement.

It’s crucial to review your statements regularly and look for any unfamiliar or suspicious charges to ensure the security of your finances.

How to Prevent Unauthorized WW Int’l-DIGITAL 800-221-2112 Charges

Maintaining the security of your bank account is of paramount importance in the digital age, where financial transactions are increasingly conducted online.

To safeguard your hard-earned money and prevent unauthorized WW Int’l-DIGITAL 800-221-2112 charges, follow these essential steps:

1. Regularly Monitor Your Bank Statements

Make it a habit to review your bank statements frequently. By checking your transactions diligently, you can quickly spot any unfamiliar or suspicious entries, including the WW Int’l-DIGITAL 800-221-2112 charge.

Early detection enables you to take prompt action if you suspect unauthorized activity, reducing the potential damage.

2. Set Up Transaction Alerts

Most banks offer transaction alerts via email or text messages. Take advantage of this feature and set up alerts for every transaction made on your account, regardless of the amount.

These real-time notifications allow you to stay informed about any activity on your account, making it easier to identify and address unauthorized charges swiftly.

3. Secure Your Personal Information

Protecting your personal and financial information is the first line of defense against unauthorized charges. Refrain from sharing sensitive details such as account numbers, PINs, or passwords with anyone.

Ensure that your passwords are strong and unique for each online account, and consider using two-factor authentication for added security.

4. Be Wary of Phishing Attempts

Phishing scams remain a common tactic used by fraudsters to obtain sensitive information.

Stay vigilant and avoid clicking on suspicious links or providing personal details in response to unsolicited emails, calls, or messages. Legitimate organizations, including your bank, will never ask for confidential information in this manner.

5. Report Lost or Stolen Cards Immediately

If you lose your debit or credit card or suspect it has been stolen, don’t delay – report it to your bank immediately. Many financial institutions offer 24/7 customer service to assist with card replacement and fraudulent activity inquiries.

Timely reporting minimizes the risk of unauthorized charges on your account.

6. Enable Account Locking Features

Some banks provide the option to temporarily lock your debit or credit card when not in use. This feature prevents any unauthorized usage even if your card information falls into the wrong hands temporarily. You can easily unlock the card when needed.

By implementing these preventive measures, you can create a robust defense against unauthorized WW Int’l-DIGITAL 800-221-2112 charges and other potential fraudulent activities.

A proactive approach to protecting your financial information is the key to enjoying a secure and stress-free banking experience.

Understanding Unknown WW Int’l-DIGITAL 800-221-2112 Bank Charges

Spotting an unfamiliar charge on your bank statement can be disconcerting, especially if it’s from “WW Int’l-DIGITAL 800-221-2112.” It’s crucial to investigate the origin of the charge and determine whether it’s legitimate or fraudulent.

By staying vigilant, requesting necessary documentation during cancellations, and promptly notifying your bank of any unauthorized charges, you can safeguard your finances and enjoy peace of mind.

I cancelled this subscription a while ago so why am I still being charged to my credit card account?