You’ve just noticed an unfamiliar entry on your bank statement—a “Chegg Order.” It’s natural to feel concerned about this unexpected charge.

In this article, we’ll break down what a Chegg order on your bank statement might entail, how to identify and address it, and steps you can take to prevent such occurrences in the future.

What Is the Chegg Order Charge?

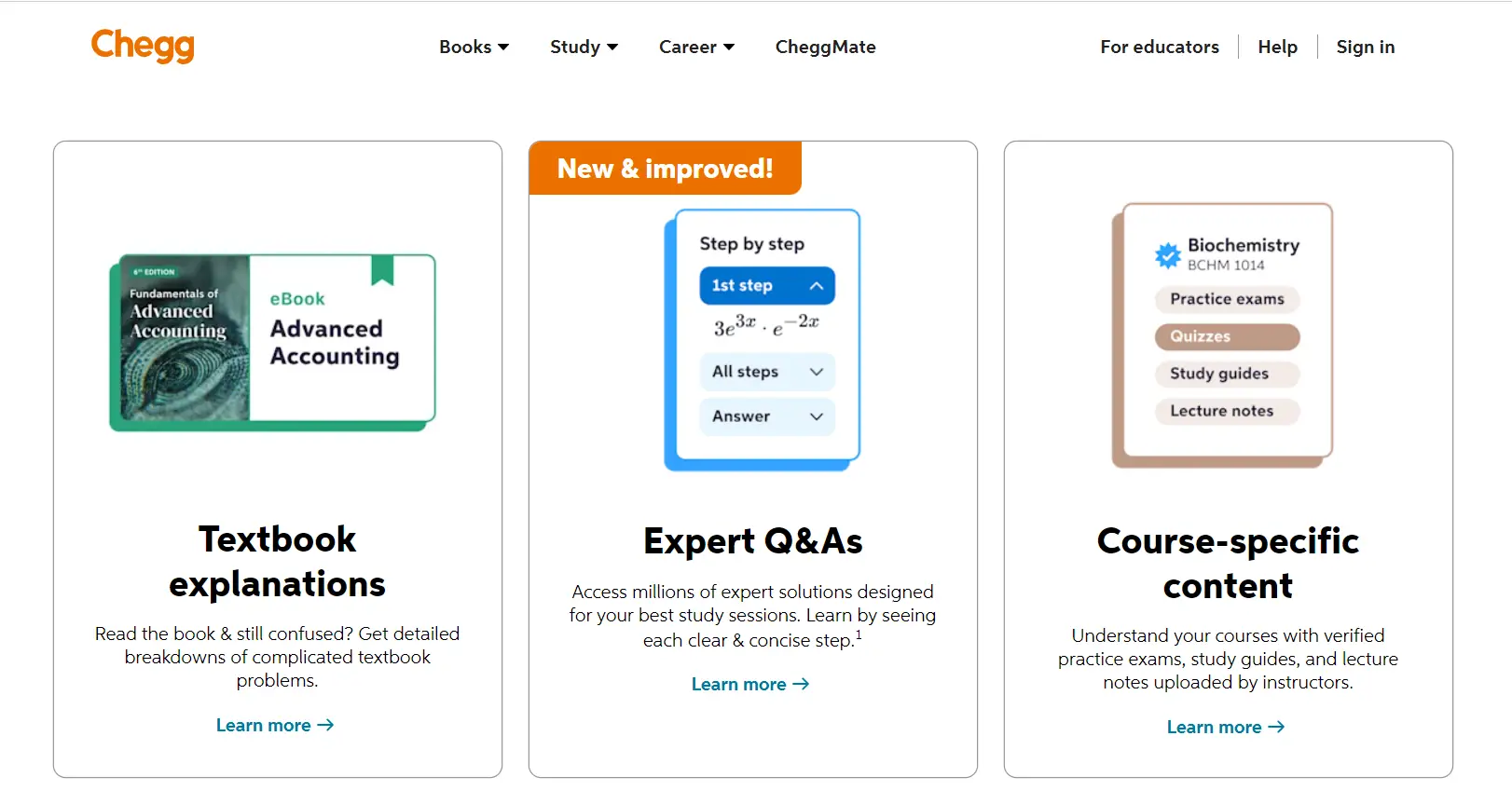

The Chegg Order charge is a transaction that signifies a purchase or service provided by Chegg, an education technology company known for its textbook rentals, online tutoring, and study resources.

When you see “Chegg Order” on your bank statement, it typically indicates that you’ve engaged in a transaction with Chegg. This might involve activities such as renting textbooks, subscribing to study resources, or accessing online tutoring sessions.

While the appearance of the Chegg Order charge may initially cause confusion, it’s essential to distinguish between authorized transactions and potential unauthorized activities.

If you recognize the Chegg Order charge as a legitimate transaction—one that you initiated—it’s likely an accurate reflection of your engagement with Chegg’s services.

However, if you don’t recall making any transaction with Chegg or believe the charge to be unauthorized, it’s crucial to take swift action.

How Does the Chegg Order Charge Look Like?

When it comes to identifying the Chegg Order charge on your bank statement, having a clear understanding of what it looks like can be instrumental.

Here’s a breakdown of the transaction entries that may appear on your statement:

- Chegg Order

- CHGG*Order

- Chegg Inc Order

- CHGG*Customer Service

- Chegg Services

- CHGG.COM

- Chegg Study

- CHGG*Subscription

These entries might vary slightly based on formatting and additional information provided by your bank. However, they typically include variations of “Chegg” or “CHGG” followed by descriptors like “Order,” “Subscription,” or “Customer Service.”

It’s important to note that these entries might not always explicitly mention “Chegg,” but they often contain keywords that associate them with the platform’s services and transactions.

Deciphering your bank statement can be perplexing, especially when encountering terms like Cardtronics.

How to Cancel a Chegg Subscription

Whether you’ve found an alternative solution or your needs have shifted, cancelling a Chegg subscription is a straightforward process. Here’s a step-by-step guide to help you navigate the cancellation process and ensure a smooth transition.

1. Access Your Chegg Account

Begin by logging into your Chegg account. This step ensures that you have the necessary access to manage your subscription settings.

Once you’re logged in, navigate to the subscription settings section. This is typically found in your account settings or under a specific “Subscription” tab.

Before proceeding with the cancellation, review the details of your subscription. This includes information such as the subscription type, renewal date, and any associated benefits.

2. Initiate the Cancellation

Click on the option to cancel your subscription. Chegg will likely prompt you to provide a reason for the cancellation. This feedback can help Chegg improve their services.

Follow the on-screen instructions to complete the cancellation process. Some subscriptions may have specific steps or additional confirmations required.

After completing the cancellation process, it’s a good practice to verify the cancellation through your account. This ensures that the subscription has been successfully cancelled.

Chegg usually provides a confirmation of the cancellation via email or on the website. Keep this confirmation for your records as proof of the cancellation.

3. Check Billing

Monitor your bank or credit card statement to ensure that you’re no longer being charged for the cancelled subscription. Sometimes, it might take a billing cycle to reflect the changes.

For certain Chegg subscriptions that involve physical items like textbook rentals, make sure to return any rented items as per their guidelines. Additionally, if your subscription included digital access, ensure that your access is revoked to prevent future charges.

4. Reach Out to Support if Needed

If you encounter any issues during the cancellation process or have questions, don’t hesitate to reach out to Chegg’s customer support. They can provide assistance and ensure that the cancellation is processed correctly.

Curious about the charges on your bank statement, like BillMatrix? Learn more about the nature of BillMatrix entries as well.

How to Prevent Unauthorized Chegg Order Charges

Preventing unauthorized Chegg Order charges requires a proactive approach to secure your financial transactions and personal information. By implementing the following strategies, you can effectively shield yourself from potential unauthorized activities.

1. Monitor Your Statements Regularly

Consistent vigilance is your first line of defense. Regularly review your bank and credit card statements, scrutinizing each transaction. Any unusual or unfamiliar charge, especially those related to Chegg, should be investigated promptly.

2. Strengthen Your Online Security

Enhance your online security by using strong, unique passwords for your accounts. Opt for two-factor authentication whenever available. This additional layer of verification adds a crucial barrier against unauthorized access.

3. Limit Sharing of Payment Information

Exercise caution when sharing your payment information online. Only provide your credit card details to reputable and trusted sources. Avoid saving payment information on multiple platforms to minimize the risk of unauthorized charges.

4. Update Contact Information

Maintain up-to-date contact information with your bank and credit card issuer. This ensures that you receive prompt notifications of any suspicious activities, allowing you to take immediate action if needed.

5. Enable Transaction Alerts

Many banks and credit card companies offer transaction alerts via email or text messages. Activate these alerts to receive real-time notifications of any activity on your account, allowing you to identify and address unauthorized charges swiftly.

6. Regularly Review Third-Party Subscriptions

Review and manage your subscriptions regularly. If you’ve previously engaged with Chegg’s services, ensure that your subscriptions are up to date and accurately reflect your usage.

7. Promptly Report Suspected Unauthorized Charges

If you notice an unauthorized Chegg Order charge or any other suspicious transaction, report it to your bank or credit card issuer immediately. They can guide you through the process of disputing the charge and securing your account.

8. Consider Using Virtual Cards

Some financial institutions offer virtual credit cards that generate a unique card number for each online transaction. This can be an effective way to prevent unauthorized charges since the virtual card number is typically valid for a single use or a limited time.

Exploring your bank statement and unsure about the BMACH entry? Find insights into understanding BMACH transactions for a comprehensive overview.

Understanding Random Chegg Order Bank Charges

Facing an unfamiliar “Chegg Order” on your bank statement can be unsettling, but remember, you have the power to address it.

By differentiating between unauthorized transactions and disputes, promptly filing a claim, and taking proactive steps like replacing your card, you can effectively manage this situation.