Have you recently come across a mysterious charge labeled “FID BKG SVC LLC Moneyline” on your bank statement? Don’t worry; you’re not alone in wondering what it is and where it came from.

In this article, we’ll delve into the details of the FID BKG SVC LLC charge and shed light on its origins. If you’ve ever dealt with Fidelity Investments Brokerage Services, or even if you haven’t, it’s essential to understand the implications of this charge.

What Is the FID BKG SVC LLC Bank Charge?

The FID BKG SVC LLC bank charge is a financial transaction that appears on your bank statement and originates from Fidelity Investments Brokerage Services.

Fidelity Investments is a prominent financial services corporation headquartered in Boston, Massachusetts, with a vast global presence, serving millions of investors, businesses, and advisory firms across North America, Europe, Asia, and Australia.

When you see the “FID BKG SVC LLC” line item on your bank statement, it signifies an outbound electronic transfer against your banking account or credit card.

This transfer is carried out through Fidelity Brokerage Service LLC’s Moneyline service and is directly related to a brokerage operation linked to your account.

The primary purpose of this bank charge is to facilitate various financial services offered by Fidelity, which encompass a broad spectrum of investment opportunities and asset management.

Through their comprehensive suite of services, Fidelity caters to individual investors seeking personal investment solutions, retirement planning, and access to a wide range of financial instruments, including stocks, bonds, mutual funds, ETFs, annuities, CDs, and more.

If you have investments, retirement plans, or any financial dealings with Fidelity Investments Brokerage Services, it is highly likely that you will encounter this bank charge periodically.

It can manifest as part of scheduled contributions to your workplace retirement program (such as a 401k) or automatic deductions for various investment services managed by Fidelity.

To understand the details of the WW Int’l-Digital charge and its implications, we recommend referring to the corresponding article on our website.

How Does the FID BKG SVC LLC Charge Appear?

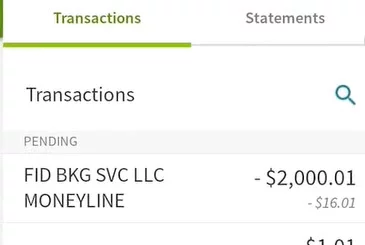

The FID BKG SVC LLC charge can appear on a bank statement in various ways, depending on the specific transaction or service associated with it.

Image Credits: Business Finance News

Here is a bulleted list of transaction entries that you might encounter:

- FID BKG SVC LLC

- FID BKG SVC

- FID BKG SVC LLC MONEYLINE

- FID BKG SVC LLC MONEYLINE ONL

- FID BKG SVC LLC MNY MKT SWEEP

- FID BKG SVC LLC NMM MKT SWEEP

- FID BKG SVC LLC CASH REDEMPTN

- FID BKG SVC LLC DRIP PURCHASE

- FID BKG SVC LLC CONTR TO IRA

- FID BKG SVC LLC CONTR TO ROTH

- FID BKG SVC LLC CONTR TO BROK

- FID BKG SVC LLC CONTR TO CESA

- FID BKG SVC LLC CONTR TO UTMA

- FID BKG SVC LLC CONTR TO 529

- FID BKG SVC LLC CONTRIBUTION

- FID BKG SVC LLC ROTH CONTRIB

- FID BKG SVC LLC TRANS IN ACCT

- FID BKG SVC LLC TRANSFER TO

- FID BKG SVC LLC DISTRIBUTION

- FID BKG SVC LLC RMD PAYMENT

- FID BKG SVC LLC ELECTRONIC

- FID BKG SVC LLC WITHDRAWAL

- FID BKG SVC LLC TRADE CHARGE

- FID BKG SVC LLC TRANS FEE

- FID BKG SVC LLC SERVICE FEE

- FID BKG SVC LLC ADVISORY FEE

- FID BKG SVC LLC INTEREST PAYMT

- FID BKG SVC LLC DIVIDEND PAYMT

- FID BKG SVC LLC DIV REINVEST

- FID BKG SVC LLC BOND INTEREST

- FID BKG SVC LLC EXPENSE RATIO

- FID BKG SVC LLC ANNUITY FEE

- FID BKG SVC LLC CUSTODY FEE

- FID BKG SVC LLC CHECK CHARGE

- FID BKG SVC LLC WIRE TRANSFER

- FID BKG SVC LLC EFT PAYMENT

- FID BKG SVC LLC ACH PAYMENT

- FID BKG SVC LLC ATM WITHDRAWAL

- FID BKG SVC LLC FOREIGN TRANS

- FID BKG SVC LLC FDIC INSURED

- FID BKG SVC LLC SECURITIES

Please note that the appearance of the FID BKG SVC LLC charge on your bank statement might include additional transaction details or descriptions depending on the specific financial activities associated with your Fidelity Investments Brokerage Services account.

Make sure you know everything about the “SXM SIRIUSXM.COM/ACCT” charge appearing on your bank statement.

How to Prevent Unauthorized FID BKG SVC LLC Charges

1. Regularly Monitor Your Accounts

One of the most effective ways to safeguard your finances and prevent unauthorized FID BKG SVC LLC charges is by regularly monitoring all your financial accounts.

Keep a close eye on your bank statements, credit card statements, and any investment accounts associated with Fidelity Investments Brokerage Services.

Frequent monitoring will enable you to quickly detect any suspicious transactions and take immediate action if necessary.

2. Set Up Account Alerts

Take advantage of your bank’s or credit card provider’s account alert features. These alerts can notify you via email or text message whenever significant transactions or changes occur in your accounts.

By setting up alerts for large withdrawals or transactions from FID BKG SVC LLC, you can promptly respond to any unauthorized activity and prevent further financial loss.

3. Secure Your Personal Information

Protecting your personal information is paramount in preventing unauthorized charges. Ensure you safeguard sensitive data such as your bank account numbers, credit card details, and login credentials for your online accounts.

Avoid sharing this information with anyone and be cautious when providing it on websites or over the phone.

4. Use Strong Passwords and Enable Two-Factor Authentication

Utilize strong, unique passwords for all your online accounts, including your Fidelity Investments account. A strong password should consist of a combination of uppercase and lowercase letters, numbers, and special characters.

Additionally, enable two-factor authentication whenever possible to add an extra layer of security to your accounts.

5. Review and Understand Your Investments

Thoroughly review and understand your investments managed by Fidelity Investments Brokerage Services. Be aware of all scheduled contributions, automatic transfers, and investment activities associated with your accounts.

If you come across any unfamiliar FID BKG SVC LLC charges, promptly investigate and verify their legitimacy with Fidelity’s customer service.

6. Report Suspicious Activity

If you suspect unauthorized FID BKG SVC LLC charges or any fraudulent activity, don’t hesitate to report it immediately. Contact your bank, credit card provider, or Fidelity Investments directly to report the incident. You can also contact Fidelity Investments using their contact number: 1 (800) 343-3548

Timely reporting will aid in resolving the issue quickly and minimizing any potential financial losses.

Educate yourself about common fraud tactics, such as phishing emails or phone calls, to protect yourself from falling victim to scams.

Understanding Unknown FID BKG SVC LLC MONEYLINE Charges

In conclusion, understanding the “fid bkg svc llc” charge on your bank statement is essential to manage your financial affairs effectively.

Whether it’s a legitimate investment service fee or a potential fraud, taking proactive steps to identify, address, and prevent such charges is crucial in safeguarding your financial well-being.

If you encounter a puzzling charge labeled “CCI Care.com” on your bank statement, make sure to verify its origin to ensure your financial security.