Have you ever been confused when checking your bank statement and come across a charge with the description “PAI ISO?” If so, you’re not alone.

PAI ISO stands for “Payment Alliance International Interchange Service Organization,” and it is a fee that banks charge for processing transactions on debit and ATM cards.

In this article, we’ll explain what the PAI ISO charge on your bank or credit card statement is, how to identify it on your statement, and what you can do to prevent it from appearing again.

What Is the PAI ISO Bank Charge?

The PAI ISO bank charge is a fee assessed by banks and financial institutions for the use of debit or ATM cards.

PAI stands for Payment Alliance International, a payment processing company that offers a range of services to banks and merchants.

Image Credits: Buildium

When you use your debit or ATM card to make a transaction, the merchant is charged a fee by the payment processor, which is then passed on to your bank or financial institution in the form of the PAI ISO bank charge.

The bank charge can vary in amount depending on the bank and the type of transaction. The fee is typically a small percentage of the total transaction amount, and it is used to cover the costs of processing electronic payments.

This includes the cost of maintaining and upgrading payment processing systems, as well as the fees charged by payment processing companies like Payment Alliance International.

What Is Payment Alliance International?

Image Credits: BizJournals

Payment Alliance International (PAI) is a leading provider of ATM and electronic payment processing services.

The company was founded in 2005 and is headquartered in Louisville, Kentucky. PAI operates one of the largest ATM networks in the United States, with over 75,000 ATMs across the country.

In addition to ATM processing services, PAI also provides electronic payment processing services to merchants and financial institutions.

The company offers a range of payment processing solutions, including credit and debit card processing, mobile payments, and point-of-sale solutions.

PAI is committed to providing innovative and reliable payment processing solutions to its customers, and the company has built a reputation for excellence in the payments industry.

An MBI SETL charge can be an early sign of a scam. Learn more about what MBI SETL means on your bank statement.

How Does the PAI ISO Charge Appear on a Statement?

The charge is a fee that appears on your bank statement whenever you use your debit or ATM card to make a transaction.

This fee is assessed by your bank or financial institution and is typically paid by the merchant who is accepting your card as payment.

When the PAI ISO charge appears on your bank statement, it will be listed as a separate line item alongside the transaction details.

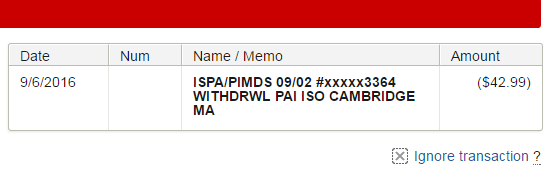

The description of the charge may vary slightly depending on your bank, but it will typically include the words “PAI ISO,” “ISPA/PIMDS Withdrawal PAI ISO” or simply “Payment Alliance International.”

It may also appear as:

- PAI ISO ATM Withdrawal

- ISPA/PIMDS PAI ISO ATM

- ATM Debit PAI ISO

- WDL PAI ISO

- PAI ISO Los Angeles

- BAL INQ PAI ISO

- PAI ISO San Francisco CA

- PAI ISO Chicago

The amount of the PAI ISO charge will also be listed on your bank statement, and it will be deducted from the total amount of the transaction.

It is important to note that the charge is a standard fee that is applied across many different banks and financial institutions.

The fee is used to help cover the costs of processing electronic payments, including debit and ATM transactions. While the fee may seem small, it can add up over time, especially if you use your debit or ATM card frequently.

If you are having trouble identifying the PAI ISO charge on your bank statement, you can contact your bank’s customer service department for assistance. They can help you understand the charge and explain how it is applied to your account.

If you come across a charge labelled VIOC on your credit card statement, here’s how to handle it.

How to Manage an Unknown PAI ISO Bank Charge

If you notice an unknown PAI ISO charge on your bank statement, there are several steps you can take to manage the situation.

1. Contact Your Bank or Financial Institution

The first step is to contact your bank or financial institution to inquire about the charge.

Ask the representative to provide details about the transaction and how the charge was applied to your account.

It is possible that the charge was made in error or that there was a mistake in the processing of the transaction.

2. Verify the Charge

Once you have obtained information about the charge, you should verify that it is a legitimate charge.

Check your records to see if you made the transaction or if someone else may have used your debit or ATM card without your permission.

If you suspect that the charge is fraudulent, report it to your bank or financial institution immediately.

3. Dispute the Charge

If you believe that the charge is incorrect or fraudulent, you can dispute the charge with your bank or financial institution. They will investigate the matter and determine if the charge should be reversed or if further action is necessary.

4. Take Preventative Measures

To prevent unknown charges from appearing on your bank statement in the future, you can take several preventative measures.

These include regularly monitoring your account for suspicious activity, safeguarding your debit and ATM cards, and using alternative payment methods when possible.

5. Seek Professional Assistance

If you are unable to resolve the issue with your bank or financial institution, you may want to seek professional assistance from a consumer protection agency or a financial advisor.

These experts can provide guidance and assistance in resolving the matter.

You may also come across a similar charge labelled Charter Services. Here’s how to handle it.

Understanding the PAI ISO Bank Charge

In summary, managing an unknown bank charge requires prompt action and careful attention to detail. By following the steps outlined above, you can effectively manage the situation and prevent similar charges from appearing on your bank statement in the future.

If you wish to prevent the PAI ISO charge from appearing on your bank statement in the future, you can consider using a different payment method, such as cash or a different type of credit or debit card.

You can also ask the merchant if they have a different payment processing option that does not incur the PAI bank charge.

I’m under identity theafmy name Is fraudulent being abuse drain my accts using this link anyone acct in my name fraudulent the abuse has caused serious damage to m good name I seriously need talk some Patricia Marie Ross 5595159541 please contact asp

Hi Patricia. If you think you’ve been a victim of identity theft and someone is taking money out of your bank accounts, you should first contact your bank and ask them to dispute the charges or stop any further transactions from your account. If it’s a serious case, make sure to report this incident to relevant authorities.