Med-I-Bank (MBI) is a healthcare payment system, designed to simplify healthcare transactions for patients, providers, and payers.

If you notice a transaction labeled “MBI SETL” on your bank statement or credit card statement, it could be related to a Med-I-Bank payment.

In this article, we will explore what Med-I-Bank is and what to do if you notice an MBI SETL payment on your bank statement.

What Is Med-I-Bank and MBI SETL?

Med-I-Bank is an electronic payment system designed specifically for the healthcare industry. MBI processes payments between insurance providers, healthcare providers, and patients.

MBI SETL is the label that typically appears on patient’s bank or credit card statements when they use the MBI payment system.

The MBI payment system provides patients with an electronic payment option for healthcare services, such as office visits, medical procedures, and prescription medications.

Instead of paying cash, patients can use MBI SETL to make payments via debit, credit card, or bank account transfer.

The Common CAP APY F1 charge can lead to unsolicited debits from your account. Make sure you know how to handle it when it does.

How Does MBI SETL Appear on a Bank Statement?

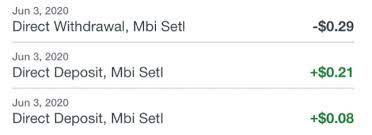

On a bank statement, MBI SETL transactions may appear as “MBI SETL,” followed by the name of the healthcare provider or service that the payment was made to.

For example, if you received a medical service from ABC Healthcare and paid using Med-I-Bank’s MBI SETL, the transaction on your bank statement might appear as “MBI SETL ABC Healthcare” or “Direct Withdrawal/Deposit Mbi Setl.”

Image Credits: ASEA Health

Additionally, some healthcare providers may have a different label name; therefore, you should always check your medical bills and receipts to confirm the source of the transaction.

It’s worth noting that MBI SETL charges or deposits can vary in amount, depending on the healthcare service’s nature and the specific healthcare provider.

Therefore, it’s essential to verify the transaction amount with your medical bill or statement.

Came across a random Paramount Plus charge in your credit card statement? Here’s how to deal with it.

How to Prevent the MBI SETL Charge

If you want to prevent MBI SETL charges, you should closely monitor your healthcare bills and payments to avoid any unauthorized transactions.

Here are some steps that you can take to prevent MBI SETL charges on your bank statement:

1. Keep Track of your Medical Expenses

One of the best ways to prevent MBI SETL charges is to keep track of your medical expenses.

By reviewing your medical bills and insurance statements, you can avoid overpayment, ensure you only pay for what you owe, and notice any unexpected or unauthorized charges.

2. Verify Payment Information

Before making any payments using MBI SETL, you should verify your payment information and ensure that all details entered are accurate.

Double-check that the amount due matches what is invoiced and if you are unsure or have any questions, do not hesitate to contact your healthcare provider or insurance company for clarification.

3. Check your Bank Statements Regularly

You should check your bank statements regularly to keep track of any charges.

Regularly evaluating your bank statements can help you identify any unusual or unauthorized transactions related to MBI SETL payments.

Here’s how you can identify an unknown Uber charge in your bank statement.

4. Report any Suspicious Activities

If you suspect any unauthorized or suspicious activities related to MBI SETL payments, you should report them immediately to your bank and healthcare provider or insurance company. They will take the appropriate measures to investigate and resolve the problem.

Should you believe that your identity has been stolen or you are a victim of fraud, you can contact the Federal Trade Commission (FTC) for assistance.

Understanding the MBI SETL Bank Charge

In conclusion, MBI SETL charges or deposit on your bank statement usually refers to a healthcare payment facilitated through the Med-I-Bank payment system.

On the bank statement, it usually appears as “MBI SETL” followed by the specific healthcare provider or service.

Regularly reviewing your medical bills, receipts, and bank statements enables you to track your healthcare payments, identify any unauthorized or fraudulent activities, and prevent potential issues.

We are a school, Chief Tahgee Elementary Academy. We have ACH charges on our bank statement from MBI SETL. We need to find out what these are for and verify that they are not fraudulent. Please contact me: Cyd Crue at 208-406-6639