Have you ever noticed a puzzling charge labeled as “Tesco PFS” on your bank statement and wondered what it means? Understanding the nature of this bank charge is essential for keeping track of your finances and ensuring its legitimacy.

In this article, we will provide insights into what the “Tesco PFS” bank charge means, how it relates to Tesco Petrol Filling Station, and address any concerns you may have about the refund process associated with this charge.

We will guide you on locating, identifying, and preventing this charge from appearing again on your bank statement.

What Is the Tesco PFS Bank Charge?

The Tesco PFS bank charge on your statement refers to a transaction made at Tesco Petrol Filling Station. This charge represents the payment you made for various services, primarily fuel, at one of Tesco’s petrol stations.

Tesco, a well-known retail supermarket chain, operates a network of petrol stations across the United Kingdom where customers can conveniently fuel up their vehicles.

When you visit a Tesco Petrol Filling Station, you have the option to pay for your fuel using a payment method linked to your bank account, such as a debit card.

The resulting charge labeled as Tesco PFS on your bank statement serves as a record of that transaction. It allows you to keep track of your expenses and maintain accurate financial records of your visits to Tesco petrol stations.

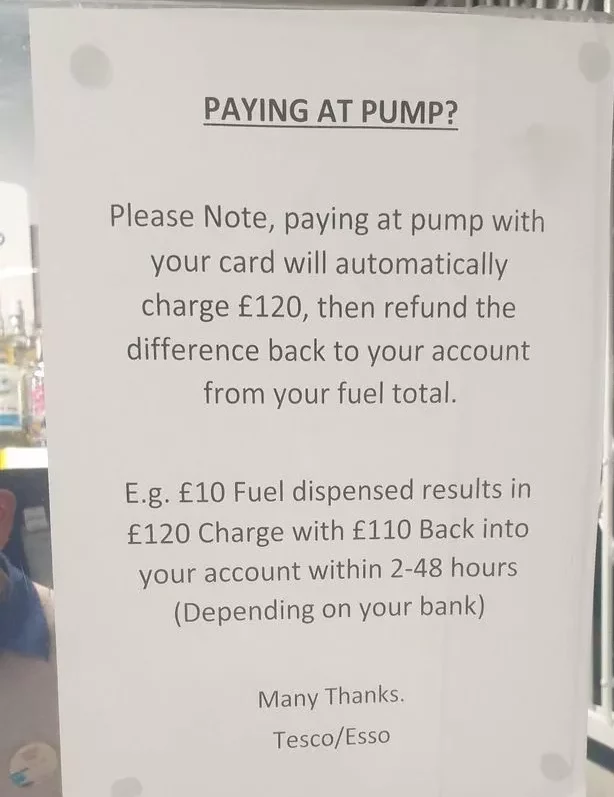

It is important to note that the Tesco PFS bank charge might appear higher than the actual cost of fuel you purchased. For example, if you fueled up your vehicle for £10, you might initially see a charge of, let’s say, £120.

This higher amount covers not only the fuel cost but also an additional amount temporarily held as a preauthorization or security deposit. However, there is no need to worry because the difference between the charge and the actual fuel cost – in this case, £110 – will be automatically refunded back to your bank account.

This refund typically occurs soon after the transaction or within a few days, depending on your bank’s processing time.

Learn more about unknown OSPC Tucker charges on your bank statement.

How Does the Tesco PFS Bank Charge Appear on Bank Statement?

When you review your bank statement, the Tesco PFS bank charge can appear in various forms, representing different types of transactions. Here is a bulleted list of possible transactions that may appear as the Tesco PFS bank charge on your bank statement:

- Tesco PFS: Fuel Purchase

- Tesco PFS: Shop Purchase

- Tesco PFS: Car Wash

- Tesco PFS: Other Services

These transactions reflect the different types of purchases and services you might have made at a Tesco Petrol Filling Station. Each transaction type represents a specific category of expenses related to your visit to a Tesco petrol station.

Came across an unauthorized Uber Trip Help charge on your credit card? Learn more about it.

How to Prevent Unauthorized Tesco PFS Bank Charges

Preventing unauthorized Tesco PFS bank charges is essential for maintaining control over your finances. Here are some proactive measures you can take to safeguard your bank account and prevent unauthorized charges:

1. Monitor Your Bank Statements

Regularly review your bank statements to identify any unfamiliar or suspicious charges. Promptly reporting and resolving any discrepancies is crucial in preventing further unauthorized charges.

2. Secure Your Payment Information

Keep your payment cards, such as debit or credit cards, secure. Avoid sharing card details over unsecured platforms and be cautious when making online purchases. Only provide your card information on trusted and encrypted websites.

3. Strengthen Your Passwords

Ensure that your online banking and card accounts have strong, unique passwords. Avoid using easily guessable information and consider using a password manager to securely store your passwords.

4. Enable Transaction Notifications

Most banks offer real-time transaction notifications via email, text messages, or mobile apps. Enable these notifications to receive alerts whenever a transaction is made using your bank account. This way, you can quickly identify any unauthorized charges and act promptly.

5. Review Pre-Authorized Tesco Payments

Regularly review your pre-authorized payments or standing orders linked to your bank account. If you no longer require a specific payment or service, cancel it to prevent any unexpected charges from occurring.

6. Be Cautious of Phishing Attempts

Exercise caution when receiving emails, calls, or messages that appear to be from Tesco or your bank. Be wary of sharing personal or financial information unless you are confident about the authenticity of the communication.

7. Contact Your Bank for Assistance

If you suspect unauthorized Tesco PFS bank charges or any fraudulent activity, contact your bank immediately. They can assist you in investigating the charges, blocking your card if necessary, and providing guidance on further preventive measures.

By following these preventive measures and staying vigilant, you can reduce the risk of unauthorized Tesco PFS bank charges and protect your finances from potential fraudulent activities.

If you come across a Wix.com charge on your bank statement, you should know more about why it was debited.

Understanding Random Tesco PFS Bank Charges

Understanding the Tesco PFS bank charge on your bank statement is essential for managing your finances effectively. It represents transactions made at Tesco Petrol Filling Stations, including fuel purchases, shop purchases, car wash services, and other related services.

By being aware of the various transactions that may appear as the Tesco PFS bank charge, you can accurately track your expenses and maintain accurate financial records.