Have you ever been confused by a WUVISAAFT charge on your bank statement? If so, you’re not alone. Many people have seen this charge on their bank statements and have been left wondering what it means.

Here’s everything you need to know about that unknown WUVISAAFT charge on your bank statement and how to prevent it from appearing in the future.

What Is the WUVISAAFT Bank Charge?

The WUVISAAFT charge on your bank statement is a payment transaction related to Western Union and Visa’s collaboration to implement a real-time push payment platform.

The Visa Direct platform allows consumers, businesses and governments around the world to send and receive money using just a phone number or email address, offering a faster, more convenient, and seamless payment experience.

The abbreviation WUVISAAFT stands for:

- WU: Western Union

- VISA: The Visa Inc.

- AFT: Account Funding Transaction

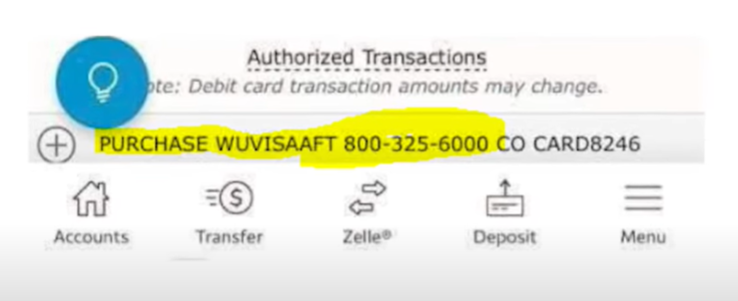

Image Credits: Hope It Helps YouTube

The implementation of Visa Direct provides many organizations with a more efficient payment system, allowing them to cater to their customers’ more complex and personalized preferences, such as instant or near-instant transfer of funds.

It’s important to know that when you make transactions using the Western Union VISA payment gateway, you may incur Wuvisaaft charges on your bank statement.

To put it simply, the Wuvisaaft charge is a financial transaction code that relates to Western Union and Visa’s integration of their platform to enable seamless, secure, and fast money transfers globally.

Western Union’s collaboration with Visa is part of the company’s plan to offer consumers, businesses, and governments new ways to make fast, secure and easy financial transactions.

The partnership leverages on Western Union’s sizeable business network and extensive knowledge and reputation in the global payments space. Visa, on the other hand, brings in capabilities such as real-time push payment delivery, speed, scale, and security.

How Does the WUVISAAFT Charge Appear on a Bank Statement?

It can be difficult to identify the Wuvisaaft debit charge on your bank statement as there are often multiple codes and descriptions given for the same transaction.

To make matters more complicated, the transaction names may differ depending on the bank and region involved. Here are some common transaction names associated with the Wuvisaaft charge on a bank statement:

- VISA Direct Payment

- WUVISAAFT 8003256000

- WU 800-325-6000 co

- WU 800-325-6000 co us

- Western Union

- WU Pay

- WU Deposit

- WU Transfer

- WU Payment

- WU Reload

- WU E-check Deposit

The 800-325-6000 in the above transactions is actually Western Union’s customer care number.

These descriptions may vary depending on the acquirer bank, processor or region, but they all refer to transactions that were initiated using the Western Union VISA payment gateway, and are a valid charge on the bank or credit card statement.

While WUVISAAFT is a legit bank charge, there are several scam charges like MGP Vinted that might be caused by fraudsters. Learn more about how to handle such charges.

How to Prevent WUVISAAFT Bank Charges

If you are looking to avoid WUVISAAFT bank charges, there are a few steps you can take to reduce the occurrence of these charges:

1. Use Your Bank for Transactions

If you frequently use Western Union for your payment transactions, you may consider opening an account with their bank partners. This option can help you avoid extra charges stemming from initiating transactions outside your bank.

2. Verify Charges Regularly

It is essential to keep track of all your transactions and balances regularly. Verify your bank balance after every transaction to ensure that the expected balance is debited from your account.

This practice helps you monitor your financial activities and confirm the presence of legitimate transactions and avoid unexpected WUVISAAFT charges.

3. Set Up Alerts

Most banks offer a reward program that lets you receive notifications whenever an account balance changes.

You can set up notifications for the branches liable for WUVISAAFT charges. This guarantees you of prompt alert for every transaction initiated using the Western Union VISA payment gateway.

4. Avoid Unnecessary Transactions

Avoid making unnecessary transactions or purchases that involve third-party payment platforms that may incur added charges, especially if those platforms are not integrated with your bank’s payment systems.

5. Always Use Secure Payment Methods

Always opt for secure payment methods. Choose payment channels that offer foolproof methods of payment, such as real-time payment platforms with encryption mechanisms and anti-fraud detection measures.

Fraudsters are known to exploit vulnerabilities in payment systems, so ensure that your payment platform is secure.

In summary, the prevention of WUVISAAFT bank charges requires a proactive approach.

Came across an unauthorized MSFX charge on your bank statement? Here’s how you should proceed.

Understanding Unknown WUVISAAFT Bank Charges

Various transaction names, such as VISA Direct Payment, Western Union, WU Payment, among others, refer to the Wuvisaaft charge on a bank statement.

It is essential to verify the presence of these transactions on your credit card statements and cross-check with your records to ensure their authenticity.

Contacting your bank’s customer service team and regularly monitoring your bank balance can help protect you against unauthorized charges, flagging suspicious activity on your account, and potential fraud.

Learn how to handle unauthorized bank charges like 365 Market today.