If you’ve recently come across a mysterious charge labeled “YesSolo” on your bank statement, don’t worry; you’re not alone. Many individuals, just like you, have been curious about this entry and what it means.

In this article, we will unravel the mystery behind the YesSolo bank charge, its connection to a company called Yes Solutions Club LTD, and its association with transactions made through Utopia Money, WalletWhale, or similar card providers.

By the end, you’ll not only be able to identify the YesSolo charge but also learn how to prevent its appearance in the future.

What Is the YesSolo Bank Charge?

The “YesSolo” bank charge is a financial transaction fee that appears on your bank statement, often causing confusion for many individuals.

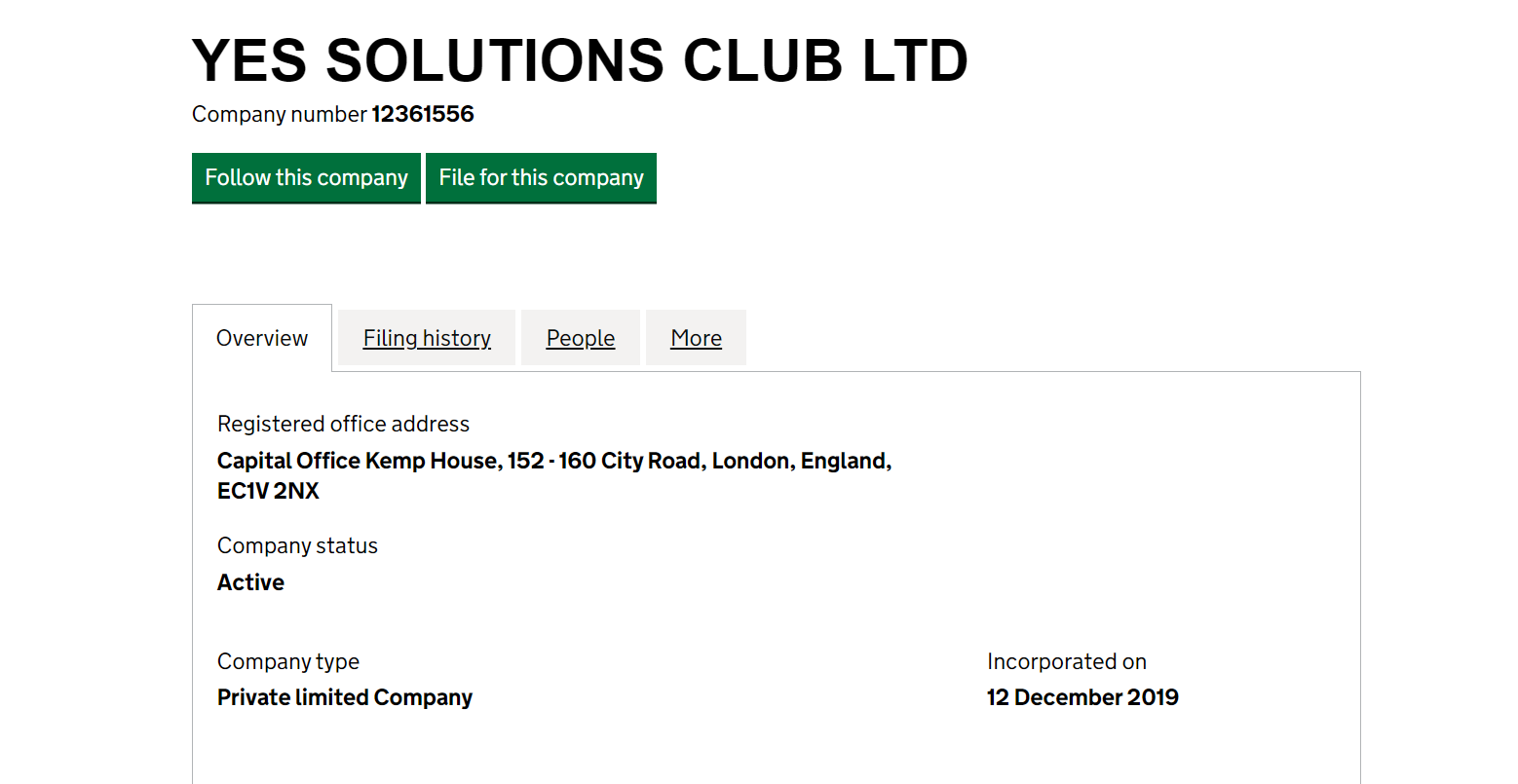

This charge is associated with a company called Yes Solutions Club LTD, and it typically arises when you engage in specific financial transactions with certain card providers, most notably Utopia Money and WalletWhale.

As a customer, it’s essential to comprehend the origin and implications of this charge to effectively manage your finances and ensure a smooth banking experience.

Yes Solutions Club LTD is a company that offers a range of services and solutions to its customers. Through partnerships with various card providers, they facilitate transactions and provide valuable benefits to their users.

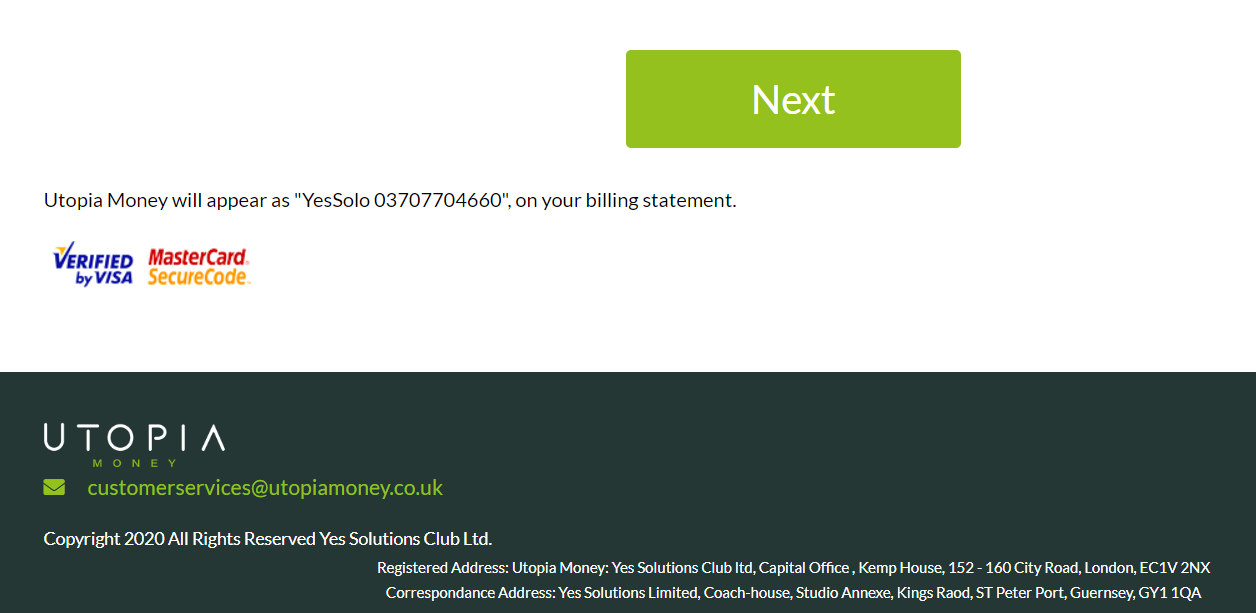

One of their prominent collaborators is Utopia Money, a card provider known for rewarding its customers with numerous money-saving deals and membership benefits. These benefits are designed to empower lifestyles and enhance the overall financial well-being of their cardholders.

When you make purchases or engage in financial activities using your Utopia Money card or any affiliated card providers, the associated service fees may be labeled as “YesSolo” on your bank statement.

While the term might appear unfamiliar, understanding its connection to Yes Solutions Club LTD and Utopia Money helps demystify the nature of the charge.

The “YesSolo” bank charge serves as a processing fee for the services provided by Yes Solutions Club LTD in association with the card provider. It is essential to remember that such fees are standard in the financial industry, and various companies may employ similar transaction charges for their services.

These fees contribute to the seamless functioning of the financial ecosystem, ensuring that card providers can offer valuable rewards and benefits to their customers.

As you continue to use your Utopia Money card or any affiliated card providers, it is crucial to keep track of your transactions and expenses. By doing so, you can easily identify the “YesSolo” charge on your bank statement and verify its legitimacy.

If you’re wondering about the unfamiliar entry on your bank statement, understand what VDP means in the context of your transactions.

How Does the YesSolo Bank Charge Appear?

The “YesSolo” bank charge may appear on your bank statement with various transaction entries, such as:

- YES SOLUTIONS CLUB LTD

- YES SOLUTIONS CLUB CHARGE

- YES CLUB FEE

- YES CLUB TRANSACTION

- YESOLO CHARGE

- YESOLO PAYMENT

- YESOLO MEMBERSHIP FEE

- YESOLO SERVICE FEE

- UTOPIA MONEY

- UTOPIA MONEY CHARGE

- WALLETWHALE PURCHASE

- WALLETWHALE TRANSACTION

Please note that these are examples of how the “YesSolo” bank charge might appear in your bank statement. The exact transaction names could differ based on the specific card provider and their partnership agreements with Yes Solutions Club LTD.

It is essential to review your statement regularly to identify and understand any unfamiliar charges effectively. By doing so, you can manage your finances efficiently and address any discrepancies promptly.

How to Prevent Unknown YesSolo Bank Charges

Preventing unknown “YesSolo” bank charges requires vigilance and proactive financial management. By implementing the following measures, you can safeguard your finances and minimize the chances of encountering unfamiliar charges:

1. Review Card Provider Terms

Familiarize yourself with the terms and conditions of your card provider, particularly regarding transaction fees and partnerships with third-party companies like Yes Solutions Club LTD.

Understanding the potential charges associated with your card will help you anticipate any “YesSolo” fees.

2. Monitor Bank Statements

Regularly check your bank statements and transaction history. Keep an eye out for any unusual or unrecognized charges, including the “YesSolo” bank charge.

Promptly address any discrepancies by contacting your card provider’s customer support.

3. Seek Transaction Details

Whenever you make a financial transaction, ensure you receive a detailed receipt or confirmation that specifies the transaction’s purpose, merchant name, and amount.

Having this information will help you verify transactions on your bank statement.

4. Contact Customer Support

If you encounter a “YesSolo” charge that you don’t recognize or believe to be erroneous, reach out to your card provider’s customer support immediately. They can investigate the charge and provide clarity on its origin.

5. Set Spending Limits

If your card provider offers the option, consider setting spending limits on your account. This can help prevent unexpected charges beyond your designated budget.

6. Opt for Transaction Notifications

Many card providers offer transaction notification services. Enable these notifications to receive real-time alerts whenever a transaction is made with your card. This way, you can promptly identify any unauthorized activity.

7. Update Card Information Securely

If you receive a new card or update your card details, make sure to do so securely. Avoid sharing sensitive information over unsecured channels to prevent potential fraudulent activities.

By adopting these preventive measures, you can safeguard yourself against unknown “YesSolo” bank charges and maintain control over your financial well-being.

Proactive management and a watchful eye will enable you to navigate your financial transactions with confidence and peace of mind.

To shed light on the mystery of your bank statement, get insights into the nature of the USConnect charge and its association with your financial activities.

Managing Unauthorized YesSolo Bank Charges

In conclusion, the YesSolo charge on your bank statement is connected to Yes Solutions Club LTD and is commonly linked to transactions made with Utopia Money or similar card providers.

Understanding the background of this charge empowers you to make informed financial decisions. By diligently monitoring your statements and taking preventive measures, you can ensure a smoother and more transparent banking experience.

Curious about the TLP charge on your bank statement? Find out the details and implications of this transaction.

I had a Yessolo transaction on my bank statement yet I’ve never signed up for a bank card that deals with them, intact I haven’t had a new bank card for many years , how is it possible for them to take money from my account?