If you’ve ever glanced at your bank statement and spotted a perplexing charge labeled “Epoch,” don’t be alarmed. This enigmatic entry might seem puzzling at first, triggering concerns about the privacy of your personal information and the possibility of unexpected monetary losses.

Epoch, an essential player in the realm of payment processing, acts as a bridge between your online transactions and the merchants you engage with.

What Is the Epoch Bank Charge?

The Epoch bank charge is a result of the pivotal role played by Epoch as a Payment Service Provider (PSP) within the complex landscape of digital payments.

As you navigate the world of online shopping and engage with various merchants, you might encounter this charge on your credit card statement, prompting questions about its origin and purpose.

When you make a purchase from an online vendor, especially those classified as high-risk merchants—such as those associated with adult entertainment or gambling—Epoch steps in to facilitate the payment process. This is where the intriguing “Epoch” charge on your bank statement comes into play.

Unlike traditional payment processors that cover a broader spectrum of transactions, Epoch specializes in handling payments from these high-risk domains.

Epoch acts as a bridge connecting your credit card with the online merchant. It securely transmits the payment information, processes the transaction, and ensures the merchant receives the payment for the goods or services you’ve purchased.

This transaction, carried out by Epoch, results in the charge that you see on your credit card statement.

Epoch provides a valuable service by handling payments for these high-risk online merchants, allowing them to receive payments from customers like you without the obstacles they might face with other payment processors.

This essential role comes at a cost, reflected in the “Epoch” charge you observe on your statement.

Discover the significance of LPS on your bank statement and understand its implications for your financial transactions.

How Does the Epoch Charge Appear on Bank Statements?

When you examine your bank statement, you might come across the Epoch charge among other transactions. The way these entries are displayed provides insight into the nature of the transaction.

The appearance of the “High-Risk Merchant Charge (Epoch)” in this list illustrates Epoch’s role in processing payments for online transactions from high-risk merchants.

As you review your bank statement, this entry serves as a clear identifier of transactions conducted through Epoch’s payment processing service.

Understanding this representation aids in effectively managing your financial records and staying informed about your online spending activities.

Unveil the mystery behind “Dave Inc” on your bank statement and gain insights into the nature of this entry.

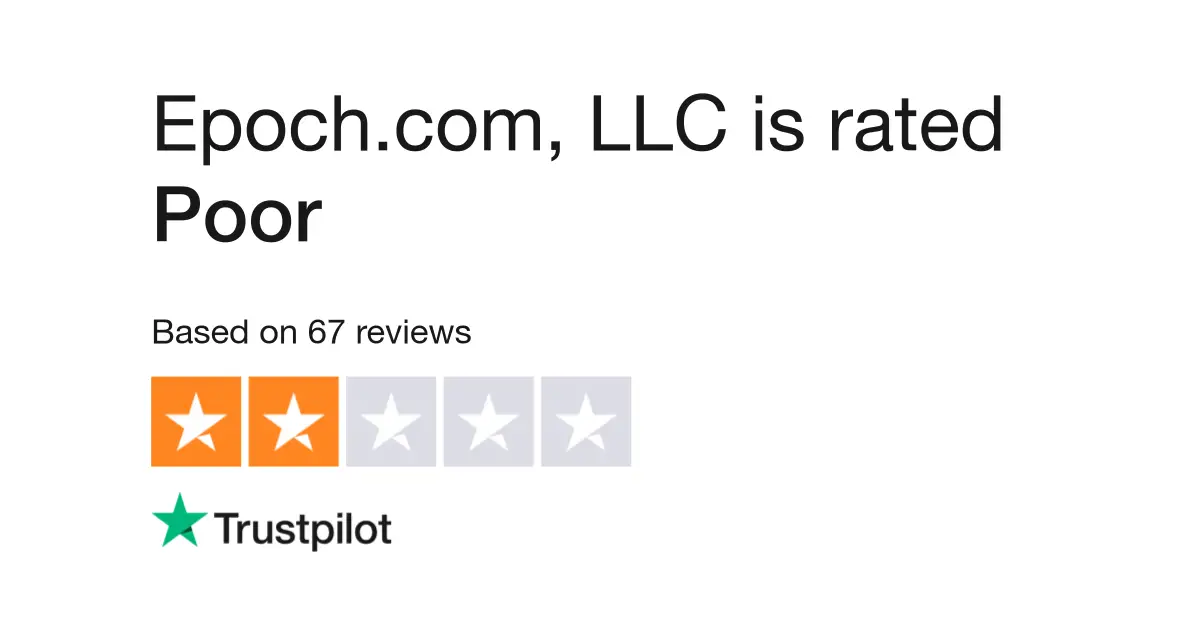

Is Epoch Payment Safe?

When evaluating whether Epoch payment is worth integrating into your financial activities, several factors come into play:

1. Industry Focus

Epoch’s specialization in high-risk merchants indicates its unique positioning. If you frequently engage with such merchants—whether for adult entertainment, gambling, or other high-risk services—Epoch provides a specialized payment solution that might not be readily available through conventional processors.

2. Security Emphasis

Epoch’s security measures reflect a commitment to user protection. If security is a primary concern for you, particularly in transactions with high-risk merchants, Epoch’s focus on encryption and fraud prevention can be reassuring.

3. Convenience and Accessibility

The convenience of utilizing a specialized payment processor like Epoch lies in its accessibility. It provides a streamlined channel for transactions with high-risk merchants, sparing you the potential complexities of engaging with more generalized processors.

4. Personal Preference

Ultimately, the decision to use Epoch payment boils down to personal preference. Assess your online spending habits, the types of merchants you engage with, and your comfort level with specialized payment solutions. Research and understand the potential benefits and drawbacks to make an informed choice.

How to Prevent Unauthorized Epoch Charges

Understanding the potential risks associated with unauthorized Epoch charges is crucial in today’s digital age. By adopting a proactive approach and implementing preventive measures, you can significantly reduce the likelihood of encountering such charges and maintain control over your financial well-being.

Here’s how you can fortify your defenses against unauthorized Epoch charges:

1. Secure Online Shopping Practices

When engaging in online shopping, exercise caution and ensure you are interacting with reputable and established merchants. Stick to well-known websites that have a track record of secure transactions.

Avoid engaging with unfamiliar or suspicious online vendors, especially those dealing with high-risk goods or services.

2. Regular Statement Monitoring

Make it a habit to regularly review your bank and credit card statements. By closely monitoring your financial transactions, you can promptly detect any unfamiliar charges, including potential unauthorized Epoch charges.

The sooner you identify discrepancies, the quicker you can take action to address them.

3. Strong Passwords and Account Security

Maintain strong, unique passwords for your online accounts, including your banking and credit card accounts. Enable multi-factor authentication whenever possible to add an extra layer of security.

Regularly update your passwords and refrain from using easily guessable information, such as birthdates or common words.

4. Review Terms and Conditions

Before making a purchase or subscribing to any online service, carefully review the terms and conditions. Understand the billing practices, trial periods, and cancellation procedures associated with the service.

This awareness can prevent unintentional recurring charges that might lead to unauthorized Epoch entries on your statement.

5. Use Secure Payment Methods

Opt for secure payment methods, such as credit cards, when conducting online transactions. Credit cards often come with added fraud protection, and in case of unauthorized charges, your liability might be limited.

Be cautious with sharing debit card information online, as it could potentially expose your bank account to unauthorized withdrawals.

6. Regularly Update Contact Information

Keep your contact information up to date with your bank or credit card issuer. This ensures that you receive timely alerts or notifications regarding any suspicious activity or transactions.

Staying informed allows you to respond quickly and mitigate potential risks.

7. Immediate Reporting of Suspicious Activity

If you notice any unfamiliar or unauthorized charges, including those bearing the label “Epoch,” immediately contact your bank or credit card issuer. Prompt reporting facilitates their investigation process and can lead to swift resolution of the issue.

8. Use Reputable Payment Processors

When engaging in online transactions, opt for reputable and well-established payment processors.

Recognized processors prioritize security and are less likely to result in unexpected charges.

Delve into the details of Digital River on your bank statement to grasp its role in your online financial activities.

Understanding Unknown Epoch Bank Charges

Epoch, as a proficient Payment Service Provider, acts as an intermediary between you and high-risk online merchants, facilitating secure and successful transactions.

While encountering an “Epoch” charge may cause initial confusion, you now possess the knowledge to identify, address, and even prevent such instances, enhancing your control over your financial landscape.

Remember, despite the intricacies of online payments, your security remains intact, and with a little awareness, you can navigate this digital realm with confidence.