Have you ever come across a mysterious charge on your bank statement that reads “SP AFF*”? It can be puzzling and leave you wondering what it actually means.

Don’t worry, in this article, we will clarify what the SP AFF* charge on your bank or credit card statement means and provide you with the information you need to understand and manage it effectively.

What Is the SP+AFF* Bank Charge?

The SP AFF* charge on your bank statement is associated with Affirm, a reputable provider of Buy Now Pay Later (BNPL) loans. With BNPL, you have the flexibility to make a purchase and pay for it over time, rather than paying the full amount upfront.

Affirm stands out among other BNPL providers due to its wide range of repayment options. Whether you prefer splitting the cost into equal monthly installments or opting for a more tailored plan, Affirm aims to accommodate your financial needs.

Image Credits: HopeItHelps YouTube

By offering these alternatives, Affirm strives to make online shopping more accessible and affordable.

When you encounter the SP AFF* charge on your bank statement, it signifies that you’ve made a transaction using Affirm’s BNPL service. This could mean that you recently indulged in an online shopping spree or made a significant purchase with the option to spread out the payments.

Regardless of the specific purchase, the SP AFF* charge acts as a friendly reminder of the financial freedom and convenience offered by Affirm.

Embracing Affirm’s BNPL option can be advantageous in various ways. It allows you to enjoy the benefits of owning the desired product immediately while providing the flexibility to manage your cash flow more efficiently.

Instead of depleting your bank account or relying on high-interest credit cards, Affirm empowers you to break down payments into manageable chunks, aligning them with your budget and financial goals.

Found an unauthorized MSFX charge on your bank or credit card statement? Here’s how you should handle it.

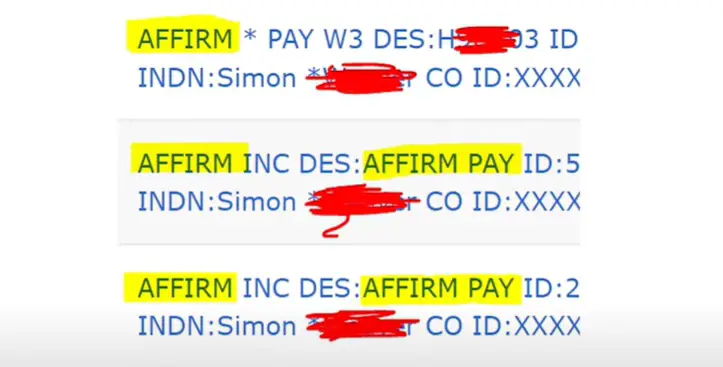

How Does the SP AFF* Charge Look Like?

Identifying the SP AFF* charge in your bank or credit card statement is essential for maintaining financial clarity and keeping track of your expenses.

To locate it, carefully review your statement and look for any transactions labeled with “SP AFF*.” These transactions will have specific names associated with them, indicating the nature of the purchase made through Affirm’s BNPL service.

Here are some examples of transaction names commonly associated with the SP AFF* charge:

- SP AFF* APPLE STORE: This transaction name suggests that you made a purchase from the Apple Store using Affirm’s BNPL service. It could be a new iPhone, MacBook, or any other Apple product you’ve been eyeing.

- SP AFF* AMAZON: This transaction name indicates that you utilized Affirm’s BNPL option for an Amazon purchase. Whether it’s a new gadget, home decor, or a collection of books, Affirm allows you to shop conveniently on one of the largest online marketplaces.

- SP AFF* BEST BUY: If you see this transaction name, it means you made a purchase from Best Buy using Affirm’s BNPL service. It could be anything from electronics, appliances, or even the latest gaming console.

- SP AFF* FASHION RETAILER: This transaction name refers to a fashion retailer where you used Affirm’s BNPL service to splurge on a new wardrobe, trendy accessories, or stylish footwear.

- SP AFF* TRAVEL AGENCY: If you spot this transaction name, it signifies that you availed of Affirm’s BNPL service to book a vacation, flights, or accommodations through a travel agency.

- SP AFF* FITNESS EQUIPMENT: This transaction name indicates that you used Affirm’s BNPL service to purchase fitness equipment, such as home gym essentials, workout gear, or fitness trackers.

- SP AFF B

- AFFIRM PAY

- SP AFF FIGS INC

- SP+AFF 855-423-3729

- SP AFF Gamma Enterprise

- SP+AFF AFFIRM

- SP AFF San Francisco CA

- Purchase SP + AFF

Remember, these transaction names are just examples, and the specific name associated with the SP AFF* charge will vary based on the merchant from which you made the purchase using Affirm’s BNPL service.

By scrutinizing your bank statement, you can easily spot the SP+AFF* charge and identify which specific transaction it corresponds to. Being able to recognize these transaction names will provide you with a clearer understanding of your spending habits and ensure accurate record-keeping.

An unknown MGP Vinted bank charge can be part of a scam. Here’s what you should do to stay safe.

Preventing Unauthorized SP AFF* Bank Charges

Unauthorized charges can cause inconvenience and frustration. To ensure that you have control over the appearance of SP AFF* charges on your bank statement, there are several preventive measures you can take.

By being proactive and implementing these strategies, you can safeguard your financial well-being. Here’s what you can do:

1. Review and Understand BNPL Terms

Before making a purchase using Affirm’s BNPL option, thoroughly review and understand the terms and conditions associated with it.

Familiarize yourself with the repayment schedule, interest rates, and any potential fees that may apply. By being well-informed, you can make sound financial decisions and avoid surprises when the SP AFF* charge appears on your statement.

2. Keep Track of Your Transactions

Regularly review your bank statements and actively monitor your financial transactions. By doing so, you can quickly identify any unexpected or unauthorized charges, including the SP AFF* charge.

Pay close attention to the transaction details and amounts to ensure accuracy. If you notice any discrepancies, contact your bank promptly to address the issue.

3. Secure Your Personal Information

Protect your personal and financial information from falling into the wrong hands. Be cautious when sharing sensitive details online and only provide them on secure and trusted platforms.

Utilize strong, unique passwords for your online accounts, and consider using two-factor authentication for an additional layer of security. By maintaining the confidentiality of your information, you reduce the risk of unauthorized transactions.

4. Enable Transaction Alerts and Notifications

Take advantage of the alert features provided by your banking app. Set up transaction alerts to receive real-time notifications whenever a transaction labeled as “SP AFF*” or any other specified criteria occurs.

These alerts can help you stay vigilant and promptly detect any unauthorized activity. If you receive an alert for a transaction you didn’t authorize, contact your bank immediately to report the issue.

5. Monitor Your Credit Reports

Regularly monitor your credit reports to ensure that there are no suspicious or unauthorized accounts or activities associated with your name.

By keeping a close eye on your credit, you can identify any potential fraudulent activities related to the SP AFF* charge or any other transactions.

6. Contact Your Bank

If you notice an unauthorized SP AFF* charge on your bank statement, contact your bank as soon as possible. Inform them about the fraudulent transaction and provide any relevant details.

The bank will guide you through the necessary steps to dispute the charge and secure your account.

By implementing these preventive measures, you can significantly reduce the likelihood of unauthorized SP AFF* charges appearing on your bank statement. Stay vigilant, maintain control over your financial information, and promptly address any concerns or discrepancies to ensure a secure banking experience.

Understanding Fraudulent SP AFF* Bank Charges

Remember, the SP AFF* charge represents a transaction made using the Affirm BNPL service, offering you more flexibility in your payment options.

By understanding this charge, finding it on your statement, and taking preventive measures, you can confidently navigate your bank transactions and make informed financial decisions.

A similar charge with the name WUVISAAFT can also leave you scratching your head. Here’s everything you need to know about it.

Could you please add to the list of names, what store they refer to?

My SP AFF charge is followied by EVOLUTION. Can you tell me what this means? I have had several charges and am getting tired of seeing that on my bank statement.

Thank you for your assistance.

Sandra Hale

[email protected]