It’s important to stay informed about the charges on your bank statement, especially when you come across unfamiliar names like “Wyre.”

Wyre is an exchange that deals with crypto to fiat and compliance solutions through APIs and dashboards. However, there have been recent scam attempts targeting residents in Wyre, so it’s crucial to be vigilant and understand any suspicious charges on your statement.

Let’s dive in and find out what the Wyre charge on your bank statement is all about and how to handle it.

What Is the Wyre Bank Charge?

Wyre refers to an exchange that provides crypto to fiat and compliance solutions through APIs and dashboards.

While this service itself is legitimate and widely used by individuals and businesses in the cryptocurrency space, it’s crucial to be aware of potential scams associated with its name.

Recent reports of scams targeting residents in Wyre have raised concerns among users, as fraudsters attempt to exploit the platform’s reputation for their illicit gains.

However, it’s essential to remember that this is a fraudulent scheme, and Wyre is not involved in any such activity.

As you seek to understand the Wyre bank charge on your statement, you might be wondering whether it’s a legitimate transaction or if you’re a victim of unauthorized activity.

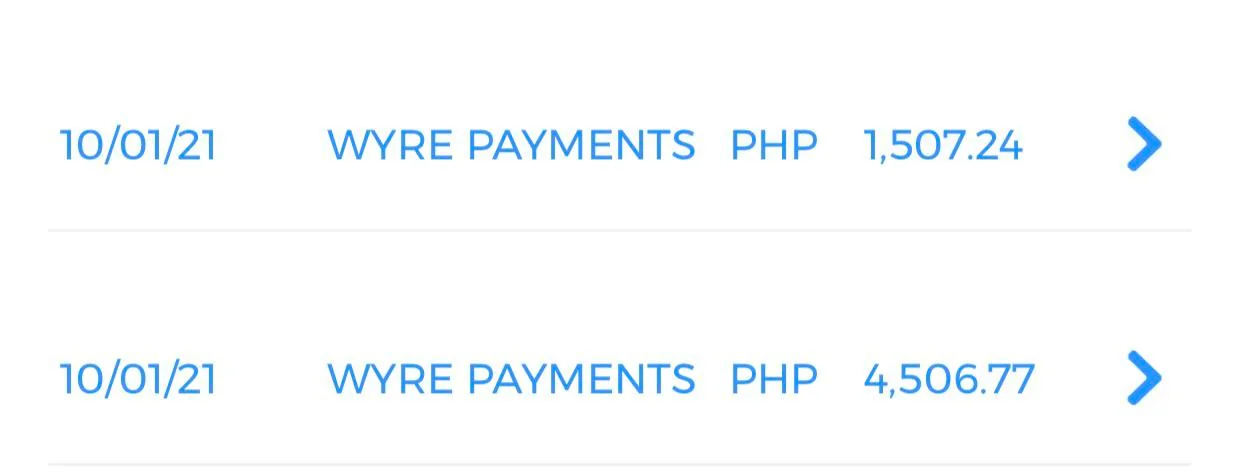

To identify the charge accurately, you can start by reviewing your statement for specific details such as the date, time, and transaction amount associated with Wyre. Furthermore, the wallet order IDs can also serve as vital identifiers.

The information provided here is for general awareness and should not be considered as legal or financial advice. For specific guidance regarding your situation, it’s always best to consult with your bank or financial institution.

To learn more about USConnect charges on your bank statement, read more.

Is Wyre a Legit Company?

Wyre is indeed a legitimate company operating in the financial technology (fintech) space, offering crypto to fiat and compliance solutions through APIs and dashboards.

The company has gained recognition and trust among users in the cryptocurrency industry for its secure and efficient services.

With its established presence, Wyre has demonstrated its commitment to providing reliable and compliant solutions for businesses and individuals engaging in cryptocurrency-related activities.

Wyre’s legitimacy is further strengthened by its transparent operations and compliance with relevant regulations. As a reputable exchange, Wyre adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) practices to ensure a secure environment for its users.

These measures help in verifying the identity of customers and detecting and preventing any potential fraudulent or illicit activities.

Moreover, the company’s track record and partnerships with established players in the fintech and cryptocurrency space add to its credibility.

Being a reputable provider of fiat-to-crypto and crypto-to-fiat conversion services, Wyre has facilitated seamless transactions for numerous businesses and individuals globally.

If you’re curious about “TLP” entries on your bank statement, find out more details here.

How Do Wyre Charges Appear on a Bank Statement?

Transactions related to Wyre charges may appear on a bank statement with clear and concise descriptions. Here’s a bulleted list of how Wyre charges may be listed on a bank statement:

Image Credit: Reddit

- Wyre Services – Crypto Purchase

- Wyre Exchange – USD to BTC Conversion

- Wyre Technologies – ETH Withdrawal

- Wyre Payments – Fiat to Crypto Transaction

- Wyre Deposit – BTC to USD Conversion

- Wyre Transfer – Crypto to Fiat Withdrawal

- Wyre Transaction Fee – Crypto Purchase

- Wyre Withdrawal – USD to BTC Transfer

- Wyre Invoice Payment – ETH to Fiat Conversion

- Wyre Purchase – Crypto to USD Transaction

Please note that the specific descriptions may vary based on the type of transaction and the bank’s statement formatting. Always review your bank statement carefully to identify Wyre charges accurately.

If you encounter any unfamiliar or suspicious transactions, it’s essential to contact your bank promptly to address and resolve any potential issues.

Discover the meaning behind Yessolo transactions appearing on your bank or credit card statement.

How to Prevent Unauthorized Wyre Charges

Preventing unauthorized Wyre charges is crucial to safeguarding your financial security and maintaining control over your accounts.

By implementing proactive measures and staying vigilant, you can significantly reduce the risk of falling victim to fraudulent activities. Here are some effective steps to prevent unauthorized Wyre charges:

1. Regularly Review Account Activity

Routinely monitor your Wyre account activity. Check for any unfamiliar transactions, especially those involving significant amounts or unexpected conversions between cryptocurrencies and fiat currencies.

If you notice any unauthorized activity, report it to Wyre immediately.

2. Use Strong and Unique Passwords

Create strong, unique passwords for your Wyre account and other financial platforms. Avoid using common phrases or easily guessable information.

Utilize a mix of uppercase and lowercase letters, numbers, and special characters to enhance password strength.

3. Beware of Phishing Attempts

Be cautious of phishing emails, messages, or websites impersonating Wyre. Scammers may try to trick you into providing sensitive information or clicking on malicious links.

Always verify the legitimacy of communications and websites before entering any details.

4. Keep Software and Devices Updated

Regularly update your computer, smartphone, and other devices with the latest software and security patches. Updated systems are better equipped to defend against potential vulnerabilities that scammers might exploit.

5. Secure Wi-Fi Connections

Avoid using public Wi-Fi networks for sensitive transactions, such as accessing your Wyre account. Public Wi-Fi can be less secure and prone to hacking attempts.

Use a secure and private network to protect your data.

6. Review App Permissions

If you’re using a mobile app for Wyre, review the permissions it requests. Grant access only to essential features and avoid giving unnecessary permissions that might compromise your security.

7. Limit Third-Party Access

Be cautious when granting third-party applications access to your Wyre account. Only use trusted and reputable services that require access for specific legitimate purposes.

8. Educate Yourself About Crypto Scams

Stay informed about the latest scams and fraud tactics prevalent in the cryptocurrency industry. Understanding potential risks will help you recognize suspicious activities and avoid falling victim to fraudulent schemes.

9. Contact Customer Support

If you have any doubts or concerns regarding your Wyre account, reach out to their customer support team. They can provide guidance, address your questions, and assist you in resolving any issues promptly.

10. Enable Two-Factor Authentication (2FA)

Take advantage of Wyre’s two-factor authentication feature, if available. By adding an extra layer of security, 2FA requires you to provide a unique verification code sent to your mobile device or email during login attempts or significant transactions.

This helps ensure that only you can access your Wyre account.

By following these preventive measures, you can significantly reduce the likelihood of unauthorized Wyre charges and maintain greater control over your financial transactions in the cryptocurrency ecosystem.

Always prioritize your online security and remain vigilant in protecting your sensitive information from potential scammers and fraudulent activities.

Understanding Unknown Wyre Bank Charges

Staying informed and vigilant is the key to protecting yourself from potential scams and unauthorized charges.

If you encounter any suspicious activities related to Wyre or any other financial matters, don’t hesitate to reach out to your bank and law enforcement to resolve the issue promptly.